- Home

- /

- Digitalization

- /

- India’s GCC Revolution: How Global…

Introduction: A Quiet Revolution with Global Ripples

Imagine a world where the back-end brains of some of the planet’s biggest companies hum away not in gleaming skyscrapers of New York or London, but in the bustling streets of Coimbatore or the tech parks of Indore. That’s the reality unfolding in India today. Global Capability Centers, or GCCs, have quietly transformed from cost-saving outposts into innovation powerhouses. These captive units, set up by multinational firms to handle everything from AI development to financial analytics, now employ nearly 1.9 million people and generate $65 billion in revenue. By 2030, experts predict they’ll hit $110 billion, creating jobs for 2.5 million more. But here’s the exciting twist: while Bengaluru and Hyderabad still lead the pack, Tier-2 cities are stealing the spotlight, thanks to smart policies, untapped talent, and a fresh wave of investments. In this piece, we’ll explore how India’s GCC story is evolving, why it’s a game-changer for global business, and what it means for the future.

The Rise of GCCs: From Cost Centers to Strategic Hubs

GCCs started as simple offshoring plays in the 1990s, focused on trimming expenses through India’s affordable skilled labor. Fast forward to 2025, and they’ve leveled up. Over 1,700 GCCs dot the landscape, with 174 from Fortune Global 500 companies alone. They’re no longer just processing data; they’re driving R&D, crafting AI models, and even influencing boardroom decisions back home.

Take the numbers: Since 2021, these centers have snapped up almost 100 million square feet of office space in seven major cities. Employment has surged, with sectors like banking and healthcare leading the charge. JPMorgan Chase, for instance, now has 55,000 employees in India, up 50% since 2018, turning the country into a “digital twin” of its global HQ. This growth isn’t accidental. It’s fueled by India’s massive talent pool, over 2 million STEM graduates annually, and a regulatory environment that’s increasingly investor-friendly.

What makes this shift compelling is how GCCs are bypassing old hurdles like U.S. H-1B visa caps. As one expert puts it, they’re not just an alternative; they’re a smarter path to talent stability and cost savings. Rising visa fees? No problem, set up shop in India and tap into 24/7 operations powered by local technologists.

Why India? Key Enablers

Several key factors underpin India’s ascendancy as a GCC location:

Talent Depth & Cost Positioning

India produces over a million STEM (engineering/IT) graduates annually and has a large English-proficient workforce. At the same time, Tier-2 cities offer substantially lower costs and even better retention, allowing companies to reduce total cost of operations by 10-35%.

Ecosystem & Infrastructure Maturing

Technology ecosystems, digital infrastructure, and corporate service maturity have all improved. Many state governments have rolled out GCC-friendly policies and incentive schemes (e.g., tax breaks, land/subsidy support).

Strategic Corporate Shifts

More companies are treating their GCCs as integral to global strategy—not just as cost centres. With shifting global risk, geopolitics and talent supply pressures (for example H-1B visa tightening), companies are rethinking delivery models. India is benefiting.

Increasing Role of Tier-2 Cities

As metros get saturated and expensive, many firms are looking at Tier-2 / Tier-3 cities in India. These cities provide compelling value: fresh talent pools, lower attrition, easier real estate, and improving connectivity.

Meet the Titans: Top GCC Players Reshaping India’s Economy

At the heart of this boom are a handful of giants whose operations span tech, finance, and beyond. These aren’t faceless entities; they’re engines of innovation, hiring thousands and injecting billions into local economies. Here’s a look at the top 10, based on their scale and impact:

- Microsoft India Development Center: Headquartered in Hyderabad, Bengaluru, and Noida, it focuses on AI, cloud, and security. Microsoft’s push here underscores India’s role in global software breakthroughs.

- Amazon India: With bases in Bengaluru, Chennai, and Hyderabad, it’s all about e-commerce tech, AI, machine learning, and even robotics. Amazon’s centers handle everything from payment systems to consumer gadgets.

- Walmart Global Tech India: Operating out of Bengaluru, Chennai, and Gurugram, this arm dives into AI, augmented reality, and cloud solutions for retail experiences, like their Sparky AI shopping tool.

- Goldman Sachs Services India: From Bengaluru and Hyderabad, it tackles financial advisory, trading, and asset management, bolstering India’s fintech prowess.

- JP Morgan Chase India: Spanning Mumbai, Bengaluru, and Hyderabad, it covers banking tech and operations, employing tens of thousands in high-stakes financial support.

- HSBC Global Technology Centers: Across Pune, Hyderabad, Bengaluru, Chennai, and Kolkata, the emphasis is on software engineering, cybersecurity, and global payments.

- Citi Global Services India: In Mumbai, Bengaluru, Chennai, and Pune, it manages data processing and institutional client services.

- Deloitte India Delivery Center: With a footprint in Hyderabad, Bengaluru, Gurugram, Mumbai, Pune, Chennai, and Kolkata, it leads in tax consulting, audits, and mergers.

- Bosch Global Software Technologies: Based in Bengaluru, Pune, and Hyderabad, it excels in IoT, sensors, and end-to-end engineering.

- Shell Business Operations: Centered in Bengaluru, it handles energy trading, IT, and AI-driven analytics.

These players aren’t just hiring; they’re upskilling workforces and fostering ecosystems that ripple outward, from startups to supply chains.

Tier-2 Takeover: Eight Cities Poised to Challenge the Big Leagues

Let’s zoom in on the growing importance of Tier-2 cities in India’s GCC story.

Why Tier-2 Cities?

- Lower cost of living / operations: Many Tier-2 cities are 10-35% cheaper than their Tier-1 counterparts, which helps companies lower TCO.

- Better retention: With slower pace, fewer distractions, Tier-2 cities often exhibit lower attrition.

- Talent availability: Many Tier-2 cities are seeing improvements in engineering / IT education and supply of talent.

- Government incentives: Several states are offering policies to attract GCCs into non-metro locations (e.g., subsidies, land, faster approvals) .

Cities gaining traction

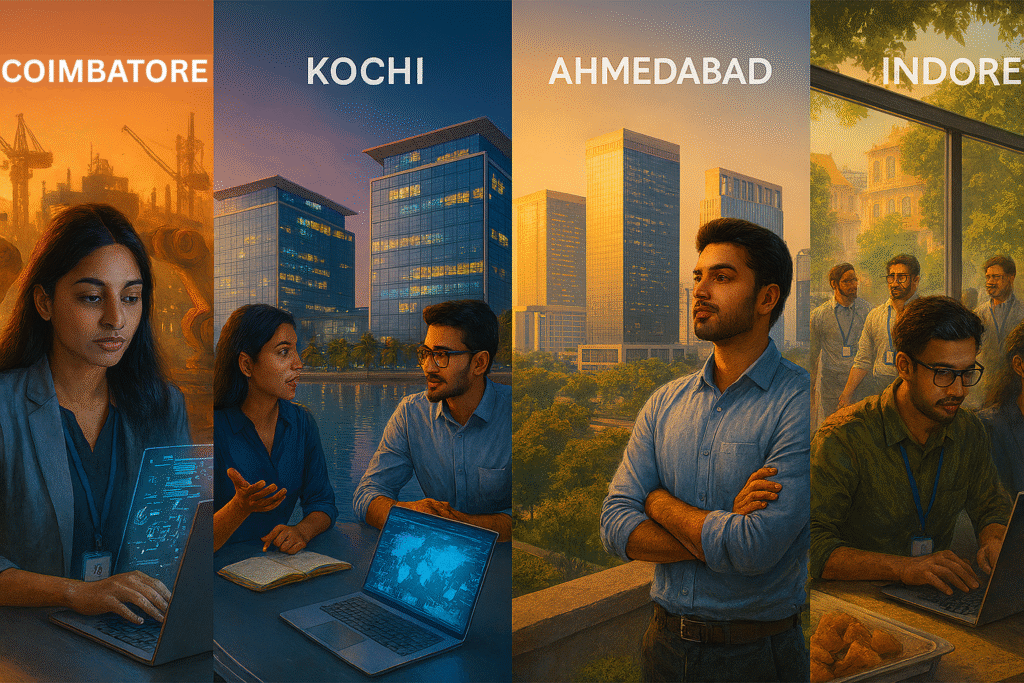

Coimbatore: The Engineering Powerhouse

Home to over 60 GCCs and 75,000 professionals, Coimbatore leverages its industrial roots for R&D in software and digital tech. Giants like Bosch, State Street, and Amazon have planted flags here.

Kochi: Innovation at the Infopark

With 580+ companies in its Infopark, including TCS and Wipro, Kochi boasts 20+ GCCs in IT and AI. Initiatives like LEAP are nurturing startups in frontier tech.

Ahmedabad: GIFT City’s Global Draw

Over 35 GCCs, from Kraft Heinz to Google and IBM, thrive in this fintech-friendly zone. Newcomers like Infineon are betting on its modern infrastructure.

Indore: FDI Magnet

₹700 crore in GCC investments and ₹5,000 crore in foreign direct investment fuel growth in IT, AI, and healthcare. It’s a hub for BFSI automation.

Lucknow: AI City Pioneer

Uttar Pradesh’s first AI City spans 70 acres, complemented by a massive Mega IT City. Policies offer land subsidies and payroll perks to lure firms.

Mysuru: Bengaluru’s Smart Neighbor

Spillover from the south’s tech capital has drawn 47 new companies since 2021. ₹1,591 crore in semiconductor investments positions it for embedded systems and OSAT.

Chandigarh Tricity: Liveability Leader

The trio of Chandigarh, Mohali, and Panchkula hosts Infosys and Tech Mahindra. Low attrition and a SaaS-fintech ecosystem make it ideal for health-tech.

Mangaluru: Mix of Scales

From Infosys (3,000 employees) to smaller outfits like Riskonnect (250), it blends large ops with specialised services.

These cities aren’t copies of Tier-1 hubs; they’re carving niches with local flavour, from Coimbatore’s manufacturing edge to Lucknow’s AI focus.

What this means for regions

- These cities will see economic spill-over: real-estate demand, service clusters, talent upskilling.

- Over time, the gap between metros and non-metros could shrink in terms of business ecosystem.

- For talent in India, this means more opportunities closer to home, reducing migration pressure to major metros.

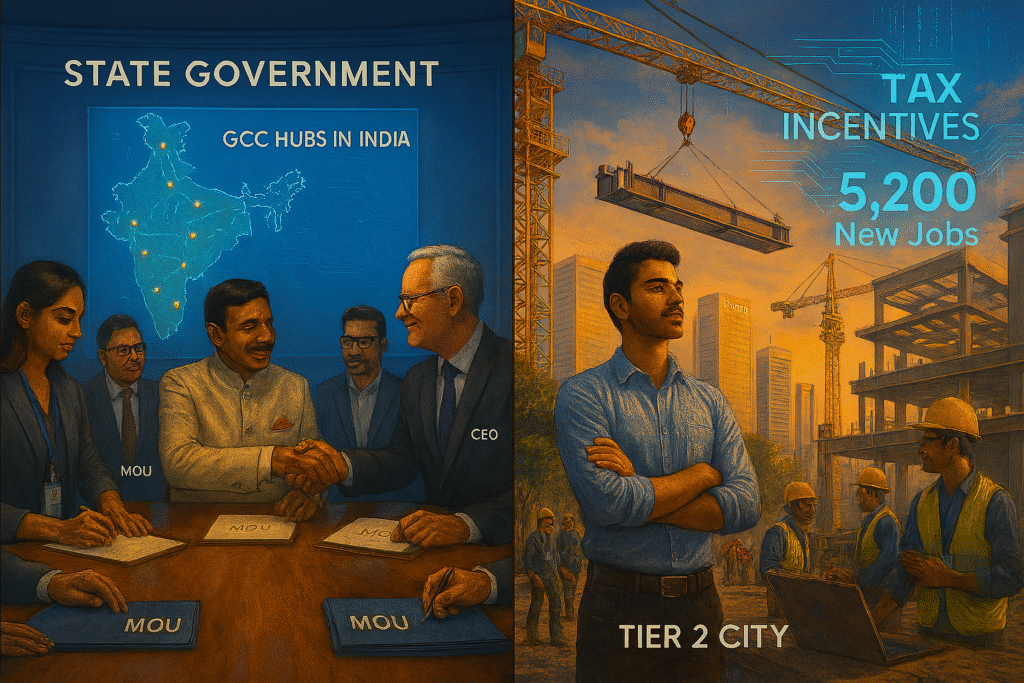

State Policies: The Secret Sauce Behind the Boom

Governments aren’t sitting idle. States are rolling out tailored incentives to supercharge GCC growth. Uttar Pradesh’s 2024 policy aims for 1,000 centers and 500,000 jobs, with full stamp duty waivers and hefty payroll subsidies. Tamil Nadu tiers its rewards for high-salary roles, pushing expansions in Coimbatore and Madurai. Gujarat targets 250+ GCCs by 2030 with ₹10,000 crore investments, offering capex support and duty refunds.

Karnataka’s Nipuna program skills up 100,000 in AI and blockchain, while its innovation districts in Mysuru and Belagavi draw 500 new GCCs by 2029. Telangana’s TS-iPASS speeds approvals, and Madhya Pradesh dangles R&D incentives for 50+ centers. Even Maharashtra inks ₹12,500 crore MoUs for GCC parks. This patchwork of policies eases business, builds talent pipelines, and upgrades infrastructure, turning states into fierce competitors for global dollars.

Sector Spotlights: Where GCCs Shine Brightest

Finance and the H-1B Edge

U.S. banks dominate, with 89 Fortune 500 firms in play. Wells Fargo (37,000 employees), Citi (32,000), and Bank of America (28,000) use India for round-the-clock trading and risk analysis. It’s a visa workaround that delivers more: deeper innovation and resilience.

Life Sciences: A New Frontier

Nearly half of the top 50 global life sciences firms have GCCs here, 23 in total, with most arriving post-2020. They handle 45% of drug discovery and 60% of regulatory work, powered by 2.7 million pros and AI tools for trials and pharmacovigilance. Bristol Myers Squibb’s $100 million Hyderabad hub and Amgen’s AI site exemplify this shift.

Non-U.S. Players Join the Party

Europe, UK, and APAC firms are catching up. Rolls-Royce opened in Bengaluru, DHL in Indore, and Maersk is deepening tech ties. Japanese outfits lead APAC’s 10% share of 2025’s 28 million sq.ft uptake.

Nano GCCs: Small Size, Big Ideas

Enter nano GCCs, compact units from VC-backed specialists in quantum computing, genomics, and space tech. Unlike mega-centers hiring thousands, these focus on elite R&D teams collaborating with startups and universities. They promise tech transfer and IP creation, giving India an edge in bleeding-edge fields. As one veteran notes, India’s digital scale is unmatched, making it the go-to for capabilities no one else can replicate.

Navigating Taxes: Insights for Savvy Setups

With great growth comes great complexity. KPMG’s insights on key tax considerations for GCCs in India point to the importance of strategic planning. Companies must navigate issues like transfer pricing, GST, the Permanent Establishment (PE) risk, and the tax implications of the evolving nature of work. A clear understanding of the regulatory and tax landscape is crucial for GCCs to operate efficiently and in compliance.

Challenges Ahead: Talent Retention and Beyond

The future for India’s GCCs is bright, but not without its challenges. The war for top talent remains fierce, pushing companies to offer more than just competitive salaries. They must provide compelling career paths, a strong culture, and opportunities for meaningful work.

Infrastructure in newer Tier-2 locations, while improving, still needs sustained investment. Furthermore, as GCCs take on more critical roles, ensuring robust data privacy and security protocols becomes paramount.

Despite these challenges, the trajectory is clear. India’s GCC ecosystem is maturing into a sophisticated innovation network that is integral to the global operations of multinational corporations. It is a two-way street: global companies get access to world-class talent, and India benefits from massive employment, skill development, and a solidified position in the global knowledge economy.

Recommended Readings

For deeper dives, these books capture the spirit of India’s business evolution:

- “The Innovators“ by Walter Isaacson – A broader tale of tech pioneers, inspiring GCC innovators.

- “The World is Flat: A Brief History of the Twenty First Century“ by Thomas L. Friedman – A foundational work on globalisation and the forces that drove outsourcing and offshoring.

- “Disciplined Entrepreneurship: 24 Steps to a Successful Startup“ by Bill Aulet – While focused on startups, this offers valuable insights into the product and market development mindsets now being adopted by GCCs.

- “India Unbound: From Independence to the Global Information Age“ by Gurcharan Das – Provides a broad historical context for India’s economic liberaliSation and its rise as a global economic power.

- “The Fourth Industrial Revolution“ by Klaus Schwab – Helps frame the technological context, AI, IoT, Big Data, that modern GCCs are built to support and innovate within.

Frequently Asked Questions (FAQ)

Q1: What exactly is a Global Capability Center?

A: A GCC is an offshore unit set up by a multinational to handle core functions like IT, finance, or R&D. Think of it as an extension of the parent company’s HQ, but optimized for local strengths.

Q2: How is a GCC different from an IT company?

A: While both employ tech talent, an IT company (like TCS or Infosys) provides services to external clients. A GCC serves only its parent organisation, working on its internal products, processes, and innovation projects. The work in a GCC is often more specialised and integrated with the core business.

Q3. What is the difference between a GCC and an outsourcing vendor?

A: A GCC is typically a captive unit (owned by the parent company) which aligns tightly with global strategy, familiar with the culture, processes and governance of the parent. An outsourcing vendor is a commercial third-party provider. The scope of work in GCCs is increasingly strategic rather than purely transactional.

Q4: Why are Tier-2 cities gaining traction for GCCs?

A: They offer 35% lower costs, better retention, and fresh talent pools, all backed by state incentives. Places like Indore and Mysuru are turning into specialised tech zones without the Tier-1 chaos.

Q5: Why is India the top choice for GCCs?

A: India offers a unique combination of a massive, English speaking, and highly skilled talent pool (especially in STEM fields), a favourable cost structure, an improving digital infrastructure, and supportive government and state policies that encourage foreign investment.

Q6: What is a “Nano GCC”?

A: A Nano GCC is a term used to describe a smaller, highly focused capability center. These centers often employ fewer people but are dedicated to a very specialised, high end function, such as advanced AI research, niche digital marketing, or proprietary product engineering.

Q7: Which are the top cities for GCCs in India today?

A: The established hubs are Bengaluru, Hyderabad, Pune, Mumbai, Delhi-NCR (Gurugram, Noida), and Chennai. The emerging hotspots include Ahmedabad, Indore, Kochi, Visakhapatnam, and Jaipur.

Q8: What kind of job roles are available in modern GCCs?

A: The roles have expanded dramatically. Beyond software engineering, you can find positions in Data Science, AI/ML research, Cloud Architecture, Cybersecurity, Digital Marketing, Advanced Engineering, Risk Management, and even R&D for life sciences and automotive sectors.

Q9: What are the benefits for India in having so many GCCs?

A: GCCs bring high-quality employment, foster skill development by training the local workforce, boost the real estate and infrastructure sectors, and contribute significantly to the Indian economy. They also elevate India’s brand as a global innovation hub.

Q10: How do GCCs help U.S. firms dodge H-1B issues?

A: By building dedicated teams in India, companies access stable, skilled labor without visa lotteries. It’s cheaper and faster, with bonuses like 24/7 productivity.

Q11: What’s the outlook for GCCs in life sciences?

A: Bright—23 of the top 50 firms are here, focusing on AI-driven drug discovery and trials. With 2.7 million experts, India’s primed for more breakthroughs.

Q12: Are there tax breaks for setting up a GCC in India?

A: Yes, states offer subsidies on land, payroll, and capex. But watch transfer pricing rules; tools like tax CoEs can optimize compliance.

Wrapping It Up: India’s GCC Moment

India’s GCC journey is more than numbers, it’s a testament to blending global ambition with local grit. From Tier-2 trailblazers to nano innovators, these centers are weaving India deeper into the world economy, sparking jobs, and fueling breakthroughs. As policies align and talent flows, expect this surge to accelerate, positioning India not just as a hub, but the heartbeat of global capability. Whether you’re an exec scouting sites or a grad eyeing opportunities, the message is clear: the action’s heating up far beyond the metros.

Leave a Reply