- Home

- /

- Venture Capital

- /

- The Rise of Tokenized Assets:…

Introduction: A New Financial Operating System

Imagine a world where moving a million-dollar Treasury bond is as easy as sending an email. Where settling a cross-border trade happens instantly, 24/7, without a tangle of intermediaries. Where a farmer in Kenya can own a fractional piece of a U.S. money market fund with a few taps on a smartphone.

This isn’t a distant sci-fi fantasy. It’s the emerging reality of tokenization, a financial revolution that is moving the world’s most valuable assets onto blockchain rails. For years, it was a niche concept, the domain of crypto enthusiasts and forward-thinking startups. But in 2024, the conversation shifted. When giants like BlackRock, Fidelity, and Franklin Templeton start launching billion-dollar tokenized funds, it’s time for everyone to pay attention.

Tokenization is the process of converting rights to a real-world asset, a bond, a share in a fund, a piece of real estate, into a digital token on a blockchain. This simple act of digitization unlocks a powerful new set of capabilities: instant settlement, global transferability, and programmability that allows these assets to interact with software and smart contracts.

This article will guide you through the why, how, and what next of this seismic shift, exploring the assets leading the charge, the infrastructure being built, and what a tokenized financial system means for investors, companies, and the global economy.

From Bitcoin to BlackRock: The Evolution of a Movement

The logic of tokenization is deceptively simple. It’s about taking assets trapped in fragmented, permissioned, and often outdated infrastructure and moving them onto programmable, global settlement rails. This isn’t just digitization; our bank balances are already digital. It’s about creating assets that are mobile and composable by design.

The journey has unfolded in three distinct waves:

- The Bitcoin Wave (2009): Bitcoin proved the concept of a digitally scarce, bearer asset that could be held and transferred without intermediaries. It laid the foundational idea of digital scarcity but was too specialized for broad financial use.

- The Ethereum and DeFi Wave (2015): Ethereum introduced smart contracts, creating a programmable financial layer. This gave birth to Decentralized Finance (DeFi), where lending and trading could occur without banks. However, this system was built almost entirely on volatile, crypto-native assets, disconnected from the real economy.

- The Real-World Asset Wave (2020 onward): This current wave brought stablecoins and tokenized real-world assets (RWAs) to the forefront. Stablecoins like USDC and USDT bridged blockchain to the U.S. dollar, creating a stable unit of account. Then, with rising interest rates making safe assets like Treasuries attractive again, the race began to tokenize them.

The timing is no accident. A perfect storm of structural drivers converged: the return of yield, technological maturity in blockchain, institutional experimentation, and gradually improving regulatory clarity.

Also Read: Fundamentals of Web3.0

The Core Asset Classes: What’s Being Tokenized Today?

Adoption is following a clear path of least resistance, starting with the safest and most liquid assets.

Stablecoins: The Foundation

Stablecoins are the undisputed success story of tokenization, with over $280 billion in circulation. They are the plumbing of the entire on-chain economy, serving as the base currency for trading, lending, and settlements. In many emerging economies, stablecoins are not speculative toys but essential tools for saving in a stable currency and conducting cross-border commerce.

Also Read: The Future of Stablecoins: From Crypto’s Cornerstone to Global Financial Infrastructure

Tokenized Treasuries and Money Market Funds

If stablecoins are the checking account, tokenized Treasuries and MMFs are the savings account. These products allow investors to hold tokenized shares of funds that invest in U.S. government debt, offering a yield-bearing, safe-haven asset that exists natively on-chain.

The credibility shift came when leading asset managers entered the fray:

- BlackRock’s BUIDL fund attracted hundreds of millions of dollars within months of its launch, signaling deep institutional trust.

- Franklin Templeton’s BENJI fund, a pioneer since 2021, has grown to nearly $750 million in assets.

- Fidelity, WisdomTree, and Wellington Management have all launched their own products, each with unique structures and investor bases.

These are not just proofs-of-concept; they are live, regulated financial products earning real yield for investors.

Also Read: Tokenomics Decoded: The Blueprint for Crypto Success and Failure

Private Credit: The Risk Frontier

Beyond safe government debt, tokenization is being applied to private credit. Protocols like Centrifuge and Maple Finance have pioneered the tokenization of invoices and loans to institutional borrowers. This offers DeFi protocols a way to diversify their collateral with real-world yield and provides new funding channels for businesses.

The journey has been bumpy, with defaults in some early pools highlighting that tokenization doesn’t eliminate credit risk. The lesson learned is that strong underwriting and risk frameworks are just as important on-chain as they are off-chain.

The Long Tail: Real Estate, Equities, and Alternatives

The potential extends to nearly every asset class:

- Real Estate: While promising fractional ownership of a $300 trillion market, progress is slow due to immense legal complexity. It remains a long-term prospect.

- Equities: The holy grail is companies issuing stock directly as tokens. We’re seeing early steps, with Galaxy collaborating with Superstate on a tokenized version of its Nasdaq-listed shares. Nasdaq itself has filed with the SEC to enable trading of tokenized securities.

- Alternatives: Everything from gold (via tokens like PAXG) to private equity funds and even fine art is being tokenized, demonstrating the technology’s flexibility.

The Mechanism: How Tokenization Works

Tokenization is a structured, multi step process that creates a legally enforceable digital twin of an asset.

- Asset Selection and Due Diligence: The process begins with identifying the asset for tokenization and conducting rigorous legal and financial due diligence to validate its legitimacy, value, and clear ownership. The legal framework is paramount to ensure the digital token’s ownership rights are legally binding and comply with regional regulations.

- Structuring and Digitization: The legal ownership rights are embedded into a smart contract, which is a self executing, verifiable agreement written directly into code on a blockchain network. The smart contract represents the terms and conditions of the asset. This process creates a digital representation of the asset on a Distributed Ledger Technology (DLT) network.

- Token Issuance: The final step involves deploying the smart contract on the chosen blockchain (such as Ethereum, Avalanche, or a permissioned enterprise chain) and minting the tokens according to the defined specifications.

This entire structure is referred to as the Tokenized Asset Stack, which combines the legal, technological, and financial layers to manage the asset’s lifecycle on-chain.

Also Check: Top Real World Assets (RWA) Coins by Market Cap

The Transformative Value Proposition

The primary driver behind the explosive growth of RWAs is the solution they offer to the biggest pain points of traditional finance.

- Fractional Ownership and Global Accessibility: By dividing a high-value asset, like a commercial building or a share of a private fund, into thousands of affordable digital tokens, tokenization radically lowers the barrier to entry for investors. Investors can purchase a fractional share of an asset, democratizing access to wealth building opportunities that were once limited to institutions and the ultra rich.

- Enhanced Liquidity: Assets that were historically considered “illiquid” (difficult to sell quickly without a significant price drop), such as real estate or private debt, gain newfound liquidity as their tokens can be traded instantly, 24/7, on secondary markets.

- Operational Efficiency and Reduced Costs: Smart contracts automate crucial, time consuming tasks like compliance checks, dividend payments, and settlements. This removes multiple middlemen from the transaction chain, drastically shortening settlement times from days to minutes, reducing friction, and lowering overall operational costs for both issuers and investors.

- Transparency and Trust: The use of a public or permissioned blockchain provides a single, immutable, and transparent ledger of all ownership and transaction history. This real time, auditable record enhances trust and makes activities like fraud and manipulation significantly harder.

The Engine Room: Infrastructure and Lingering Challenges

For all its promise, tokenization is not yet a seamless experience. Its growth is constrained by operational bottlenecks in the underlying “tokenized asset stack.”

- Fragmented Issuance: There’s no standard legal blueprint. Some tokens are direct fund shares, others are claims on a Special Purpose Vehicle (SPV), and some offer synthetic exposure. This lack of standardization hinders interoperability.

- The Custody Conundrum: Custody is complex because it involves two layers: the custody of the underlying asset (e.g., the Treasury bond at BNY Mellon) and the custody of the digital token itself (e.g., with a crypto custodian like Coinbase Custody). Keeping these in sync is crucial.

- The Liquidity Problem: Many tokenized assets today have limited or no secondary market trading. They often must be redeemed directly with the issuer, which undermines the promise of 24/7 liquidity. Building deep, liquid markets is the next great challenge.

- Compliance by Design: Regulated securities can’t circulate freely. The solution is “compliance by design,” where tokens themselves are programmed with rules, using standards like ERC-3643, that restrict transfers to whitelisted, KYC-approved wallets. This balances programmability with legal obligations.

Also Read: Fundamentals of Blockchain

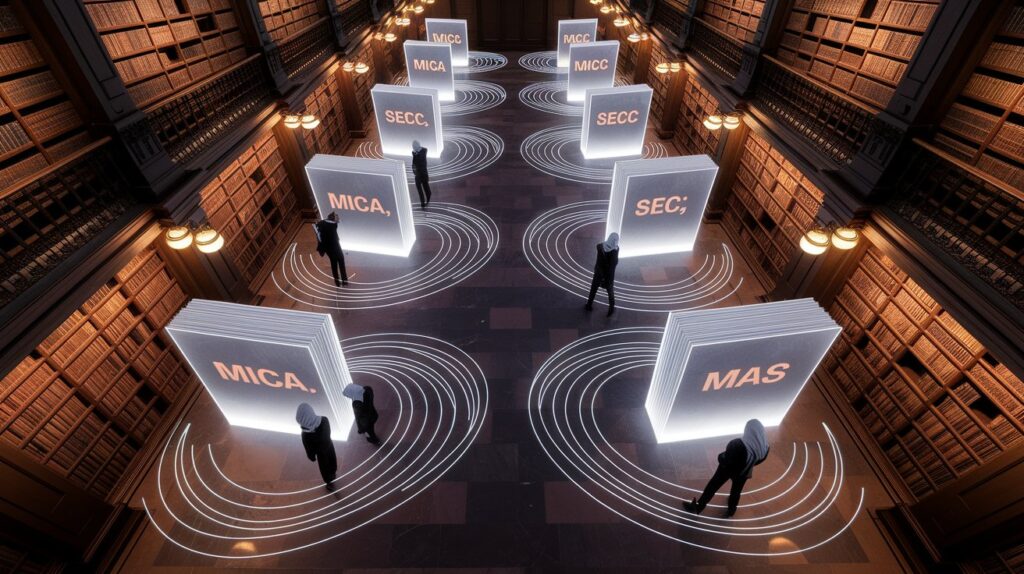

Navigating the Global Regulatory Maze

Tokenization doesn’t exist in a legal vacuum. It collides with securities, payments, and market infrastructure law. The regulatory landscape is a global patchwork:

- United States: The SEC has been cautious, largely viewing tokenized assets as securities. Issuers navigate a complex web of exemptions, but recent political support and guidance are opening the door for more activity.

- European Union: The EU has taken a proactive, if rigid, approach with MiCA for crypto-assets and the DLT Pilot Regime, a sandbox for experimenting with tokenized securities.

- Singapore & Hong Kong: These Asian hubs are leading with clear, supportive frameworks. Singapore’s Project Guardian is a live multi-bank initiative, while Hong Kong has formalized a comprehensive stablecoin licensing regime.

- Emerging Markets: In countries like Argentina, Nigeria, and Brazil, tokenization is less about optimization and more about financial access, providing a lifeline to stable dollars and safe assets.

The Road Ahead: Scenarios for a Tokenized Future

Where is all this headed? Analysts project the market for tokenized assets could reach anywhere from $1 trillion to nearly $4 trillion by 2030. The path likely lies in one of three scenarios:

- Gradual Adoption: A steady, year-by-year expansion led by Treasuries and MMFs within existing regulatory constraints.

- Accelerated Convergence: The lines between stablecoins and tokenized Treasuries blur. Why hold a zero-yield stablecoin when you can hold a yield-bearing, equally liquid tokenized Treasury? This could trigger explosive growth.

- Disruptive Catalyst: A financial crisis or regulatory shift creates a “Eurodollar moment” where tokenized structures provide a solution the traditional market cannot, leading to non-linear, rapid adoption.

Also Read: SAFE vs SAFT vs SAFE+T: The Startup Fundraising Contracts Shaping Crypto and Web3

Recommended Reading

To deepen your understanding of the concepts behind this transformation, consider these books:

- “The Price of Tomorrow: Why Deflation is the Key to an Abundant Future” by Jeff Booth – While not about tokenization directly, this book brilliantly explains the technological deflation that blockchain and similar technologies bring, providing the essential “why” behind the need for a financial system upgrade.

- “The Infinite Machine: How an Army of Crypto-hackers Is Building the Next Internet with Ethereum” by Camila Russo – This engaging narrative tells the story of Ethereum’s creation, providing crucial context for the programmable blockchain layer that makes tokenization possible.

- “Broken Money: Why Our Financial System is Failing Us and How We Can Make it Better” by Lyn Alden – Alden offers a deep historical and technical analysis of money and financial systems, framing the current challenges that technologies like tokenization aim to solve.

- “The Future of Money: How the Digital Revolution Is Transforming Currencies and Finance” by Eswar S. Prasad – A comprehensive look at the broader digital transformation of finance, including central bank digital currencies (CBDCs), cryptocurrencies, and the impact on global economics.

Frequently Asked Questions (FAQ)

Q1: What’s the difference between a digitized asset and a tokenized asset?

A: A digitized asset is simply one that exists in electronic form, like the number in your bank account or an entry in a securities ledger. A tokenized asset is also digital, but it’s represented by a token on a blockchain, making it natively transferable, programmable, and capable of interacting with smart contracts and other tokens.

Q2: What is the core difference between a Real World Asset (RWA) and a cryptocurrency?

A: A cryptocurrency (like Bitcoin or Ethereum) is a native digital asset; its value is generated within the crypto ecosystem. An RWA token, on the other hand, is a digital representation (token) of an asset that has intrinsic value in the physical world, such as a gold bar, a bond, or a property. The token’s value is derived from the underlying physical or financial asset.

Q3: Is RWA tokenization regulated?

A: The regulatory environment is evolving and complex. Since many RWA tokens represent securities (like stocks or bonds), they are often subject to existing securities laws, requiring issuers to comply with regulations like Know Your Customer (KYC) and Anti Money Laundering (AML) protocols. New regulatory frameworks, such as the EU’s MiCA, are being developed specifically to address digital assets.

Q4: Are tokenized assets safe?

A: Like any financial product, safety depends on the structure. A tokenized Treasury fund from a reputable asset manager like BlackRock, which holds its underlying assets with a custodian like BNY Mellon, has a high degree of safety regarding its reserves. However, risks always exist, including smart contract bugs, operational errors, and the regulatory status of the token itself. Always scrutinize the issuer, custodian, and legal structure.

Q5: Can retail investors buy tokenized assets?

A: Currently, most tokenized assets like Treasury funds are offered under securities law exemptions that limit them to “Accredited Investors” or “Qualified Purchasers.” Some products, like certain shares of Franklin Templeton’s and WisdomTree’s funds, are available to retail investors, but this is still the exception. As regulation evolves, retail access is expected to broaden.

Q6: What are the main benefits of RWA tokenization?

A: The main benefits are fractionalization, which allows investors to own a portion of an expensive asset, enhanced liquidity, which makes assets easier to trade, and increased transparency, as all transactions are recorded on an immutable ledger. It also leads to reduced transaction costs and faster settlement times.

Q7: How does tokenization benefit the average person?

A: In the long run, tokenization promises lower fees, greater access to investment opportunities (like private credit or real estate), faster settlement times, and the ability to use assets in new ways (e.g., using a tokenized fund as collateral for a loan in a DeFi protocol). In many emerging markets, it already provides access to stable currencies and a hedge against inflation.

Conclusion: The Inevitable Merge

The transformation will not happen overnight. We will likely see years of hybrid models, with tokenized wrappers sitting alongside traditional assets. But the direction is undeniable. The gravitational pull of efficiency, liquidity, and global access is too strong.

As Steven Goldfeder of Offchain Labs aptly put it, we tend to label things “DeFi” and “TradFi,” but the people in traditional finance just say they “work in finance.” In the future, these distinctions will fade. We will have one financial system, a system that is faster, more accessible, less expensive, and built on the powerful, programmable rails of tokenization. The rebuild of global finance has begun.

Leave a Reply