Introduction: A Turning Point for India’s Crypto Future

For years, India’s relationship with cryptocurrency has been a tense dance of immense potential and regulatory uncertainty. The industry has lurched from a proposed ban to punitive taxes, leaving innovators and investors in a state of limbo. But a new vision for India’s crypto future has emerged, not from the halls of Parliament, but from the heart of its own tech ecosystem.

Enters the Crypto-systems Oversight, Innovation and Strategy (COINS) Act, 2025. Crafted by venture capital firm Hashed Emergent and policy think tank Black Dot Public Policy Advisors, this “model law” is a comprehensive blueprint for what pro-innovation, rights-based crypto regulation in India could look like. It’s not yet official legislation, but it’s a powerful opening statement in a crucial conversation.

The Current State of Crypto in India

India’s crypto scene is booming, with millions of users trading billions in digital assets annually. Yet, it’s been a rocky road. Since the Supreme Court lifted the 2018 banking ban on crypto in 2020, the sector has faced patchy oversight. Taxes are steep: a 30% flat rate on gains from virtual digital assets (VDAs) and a 1% tax deducted at source (TDS) on transactions over certain thresholds. This has pushed many developers and projects offshore, seeking friendlier environments like Singapore or the EU.

Regulators like the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI) have stepped in with anti-money laundering (AML) rules, but there’s no unified framework. The result? Confusion for investors, stifled innovation, and a missed opportunity for India to lead in Web3. Enter the COINS Act, a timely response from industry insiders aiming to flip the script.

| Also Read: Fundamentals of Web3.0

Introducing the COINS Act: Purpose and Origins

The Crypto-systems Oversight, Innovation, and Strategy (COINS) Act 2025 is not an official government bill but a model law crafted by Hashed Emergent, a Web3 venture firm, and Black Dot Public Policy Advisors, a think tank specializing in fintech policy. Released in mid-2025, it draws inspiration from global standards like the EU’s Markets in Crypto-Assets (MiCA) regulation and Singapore’s sandbox approach, while rooting itself in India’s constitutional rights.

At its heart, the act pushes for a “rights-first” philosophy. It treats crypto activities as extensions of fundamental freedoms, countering what proponents call “crippling overregulation.” Tak Lee, CEO of Hashed Emergent, emphasizes in the foreword how India risks losing its demographic edge without pro-innovation policies. Mandar Kagade, founder of Black Dot, highlights its role in empowering individuals and fostering transparency.

The goal? To create an onshore protocol economy where Indian builders and users thrive, without blanket bans or punitive measures.

| Also Read: The Future of Stablecoins: From Crypto’s Cornerstone to Global Financial Infrastructure

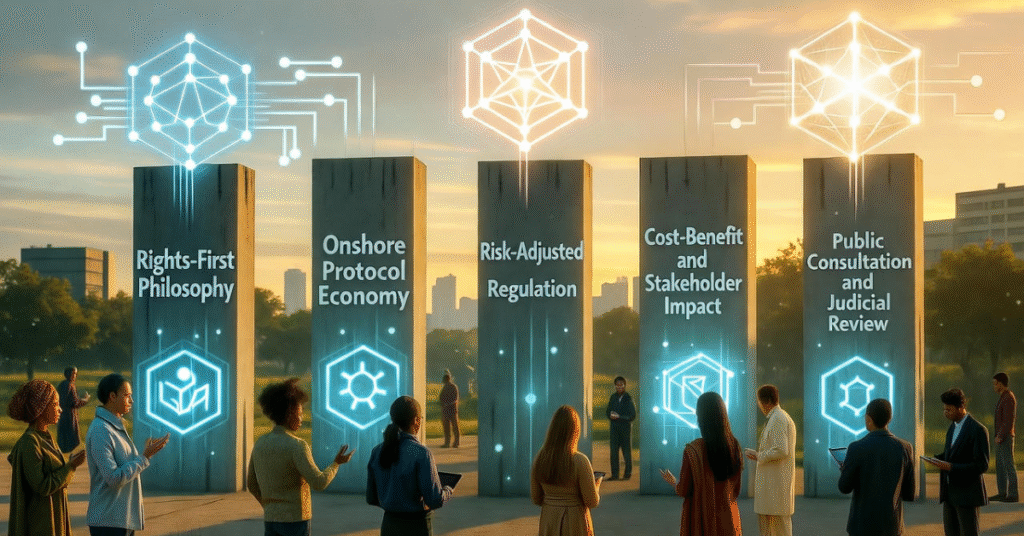

Core Principles Guiding the Act

The COINS Act rests on five pillars:

- Rights-First Philosophy: It enshrines crypto rights as counterweights to overregulation, drawing from constitutional freedoms.

- Onshore Protocol Economy: Incentives for locals to build and engage with protocols, reducing offshoring.

- Risk-Adjusted Regulation: Oversight scales with user risk, light for decentralized systems, stricter for custodians.

- Cost-Benefit and Stakeholder Impact: Every rule must justify its value against rights infringements.

- Public Consultation and Judicial Review: Transparency through consultations, analyses, and court checks.

These principles ensure regulation is proportional, tech-neutral, and focused on real harms.

| Also Read: Tokenomics Decoded: The Blueprint for Crypto Success and Failure

The Bill of Crypto Rights: Empowering Users and Builders

One of the act’s standout features is the Bill of Crypto Rights, which reasserts constitutional freedoms in the digital realm. It prohibits arbitrary restrictions unless they’re reasonable, proportional, and backed by public input.

Key rights include:

- Right to Build and Innovate: Anyone can think, invent, deploy code, or participate in crypto systems without undue barriers.

- Right to Property and Self-Custody: Hold, transfer, or delegate assets without forced intermediaries. Self-custody via non-custodial wallets is protected, and users can exit custodial services anytime.

- Right to Privacy and Anonymity: No mandatory KYC for peer-to-peer or protocol interactions, only for regulated providers. Privacy tools like encryption are encouraged.

Taxes on crypto income are allowed but must not be punitive and should differentiate asset types. This directly tackles India’s current 30% tax regime, which many see as discouraging participation.

| Also Read: Fundamentals of Blockchain

A Specialized Regulator: The Crypto Assets Regulatory Authority (CARA)

Gone are the days of overlapping jurisdictions. The act proposes CARA as a dedicated body, excluding RBI, SEBI, and others from crypto oversight. CARA’s scope is ringfenced to India-facing entities, those marketing to Indians or deriving over 25% of users/transactions from India.

Regulation is delegated by sector:

- Crypto-Asset Service Providers (CASPs): Custodial entities like exchanges face prudential rules.

- Non-Custodial Protocols: Light-touch disclosures only, reflecting low risk.

- Stablecoins and Issuers: Specific rules in consultation with RBI.

Fully decentralized systems? Completely exempt, rewarding genuine neutrality.

| Also Read: SAFE vs SAFT vs SAFE+T: The Startup Fundraising Contracts Shaping Crypto and Web3

Innovation Accelerators: Safe Harbors and More

To spark growth, the act introduces safe harbors:

- Developer Safe Harbor: No liability for third-party misuse of code, unless intentional.

- ICOs Safe Harbor: Two-year window for token sales to Indians under streamlined disclosures.

- Decentralized Systems Safe Harbor: Exemptions for sufficiently decentralized protocols and networks, defined rigorously (e.g., open-source code, no central control).

- FEMA Suspension: Two years off from foreign exchange rules to ease cross-border deals, giving time for harmonized regulations.

These measures aim to nurture native Indian protocols and attract global projects.

Building a Strategic Crypto Reserve

In a forward-thinking move, the act mandates a Strategic Bitcoin Reserve and a broader Crypto-Assets Reserve. Seeded with forfeited assets, these would diversify national holdings and signal India’s crypto leadership. A Reserve Office would manage them, with annual public reports for transparency. Only court orders or victim restitution could touch the funds.

This echoes calls from figures like BJP spokesperson Pradeep Bhandari for a Bitcoin pilot, positioning India alongside nations like the US in viewing crypto as strategic.

How It Interacts with Existing Laws

The COINS Act overrides inconsistencies in other laws, clarifying crypto isn’t a “payment system” under PSS Act or a “collective investment scheme” under SEBI rules. It also pauses FEMA applicability for two years, paving the way for tailored forex rules.

Reactions and Broader Impact

Industry voices are buzzing. Hashed Emergent’s Arvind Alexander calls it a “pro-innovation response,” while CoinsPaid CEO Max Krupyshev sees growing interest in reserves. Critics worry about risks, but overall, it’s viewed as a game-changer that could stem the brain drain and boost adoption.

If adopted, it could make India a Web3 hub, aligning with global trends while protecting rights. Workshops with regulators and events like those with Bharat Web3 Association are already underway to push it forward.

Challenges and Cautions

No proposal of this scale is free from criticism.

Some policy analysts question whether a separate regulator like CARA is practical, given the overlap between crypto, finance, and technology. Others worry that privacy guarantees could clash with India’s anti-money-laundering laws and terror financing.

Crypto’s pseudonymous nature has always raised red flags for agencies concerned with anti-money laundering (AML), counter-terrorism financing (CFT), and national security. The COINS Act’s rights-first approach, particularly its protection for anonymous transactions, could be seen as running counter to those priorities. It proposes that privacy be preserved for peer-to-peer activity but regulated when intermediaries are involved. Whether that balance can realistically prevent illicit flows while protecting individual privacy remains an open question.

There are also fiscal concerns: revising the 30 per cent crypto tax and 1 per cent TDS would require parliamentary action and political will. Without tax reform, even the best regulation may not revive India’s crypto markets.

Finally, implementation is key. The law’s success depends on how it is executed, how CARA works with RBI and SEBI, how “sufficient decentralisation” is measured, and how quickly courts interpret the new rights.

Recommended Reading

To deepen your understanding of the ideas behind proposals like the COINS Act, consider these foundational books:

- “The Bitcoin Standard“ by Saifedean Ammous: A deep dive into the economic history of money and Bitcoin’s potential role as a decentralized, apolitical monetary standard.

- “The Sovereign Individual” by James Dale Davidson and Lord William Rees-Mogg: A provocative book that explores how technology, including cryptography, will shift power from nations to individuals in the 21st century.

- “Digital Gold“ by Nathaniel Popper: The engaging story of Bitcoin’s early years and the pioneers who built the ecosystem, providing crucial context for the crypto world today.

- “The Infinite Machine“ by Camila Russo: A thrilling account of the creation and rise of Ethereum, which is essential for understanding smart contracts and the world of decentralized applications that the COINS Act seeks to regulate.

Frequently Asked Questions (FAQ)

Q1. Is the COINS Act 2025 now a law in India?

A: No, not yet. The COINS Act is a “model law” or a detailed proposal drafted by private entities (Hashed Emergent and Black Dot). It is intended to inform and influence the official government’s upcoming discussion paper and eventual legislation. It is the industry’s opening bid in a regulatory conversation.

Q2. How does the COINS Act handle taxes on crypto?

A: The Act strongly argues against “punitive taxes.” It states that Indians have a right to transact crypto assets without being subject to taxes that are designed to discourage the activity. It seeks a tax regime that is reasonable and distinguishes between different types of crypto assets (e.g., long-term holdings vs. frequent trading).

Q3. What is a “Sufficiently Decentralized” protocol?

A: This is a key definition in the Act. A protocol or network is considered “sufficiently decentralized” if no single person or group can control, censor, or modify transactions; if its source code is open-source and audited; and if anyone can use, build on, or help operate it without permission. Bitcoin and Ethereum are prime examples.

Q4. Does this mean no more KYC for crypto in India?

A: Not exactly. The COINS Act proposes that KYC should only be mandatory when using regulated intermediaries, like centralized exchanges (Crypto-asset Service Providers). Pure peer-to-peer transactions or interacting directly with a decentralized protocol would not require KYC, preserving financial privacy.

Q5. Who would regulate crypto under this proposed law?

A: The Act proposes creating a brand new, specialized regulator called the Crypto-asset Regulatory Authority (CARA). It aims to consolidate all India-facing crypto oversight under this new body, rather than splitting it between existing regulators like RBI or SEBI.

Conclusion

The COINS Act 2025 isn’t just a document, it’s a call to action for a balanced crypto future in India. By prioritizing rights, innovation, and strategic reserves, it addresses long-standing pain points and sets a global standard. Whether it becomes law or sparks debate, it’s a step toward empowering millions in the digital economy. As India stands at this crossroads, embracing such frameworks could unlock immense potential.

Leave a Reply