- Home

- /

- Entrepreneurship

- /

- Cap Table Guide for Founders

Introduction

As a founder, you’re building something that could potentially change the world, but there’s more to success than just a great product or service. One key aspect often overlooked is equity management—and at the heart of it lies the Cap Table (Capitalization Table). For any founder, understanding the dynamics of a cap table is crucial. It’s your blueprint for who owns what in your company, and it influences future funding rounds, your control over the business, and eventual exit strategies.

Inconsistent as this may sound, a lot of founders don’t pay enough attention to their cap table until it’s too late. Whether you’re just starting out, raising your seed round, or heading toward Series A, getting a firm grasp on your cap table should be your first move. Here’s everything you need to know.

What is a Cap Table?

A Cap Table is essentially a spreadsheet (or specialized software) that outlines the ownership stakes in a company. It lists all shareholders—founders, employees, investors, and any other equity holders—along with the number of shares or units each owns, the type of shares, and the percentage of ownership this represents.

The cap table also includes other information like stock options, convertible notes, and any dilution events that may affect shareholding in the future. In simpler terms, it’s a constantly evolving document that tracks the ownership structure of your company. Think of it as your equity bible.

Why is a Cap Table Important?

A cap table is far more than just a record of ownership. It affects decision-making, control, and funding opportunities. Here’s why it’s critical:

- Investor Transparency

- When raising funds, investors want to see who owns what and how their investment will impact future ownership.

- Employee Equity Plans

- Founders often use equity to attract talent. A clear cap table helps determine how much stock you can offer without over-diluting yourself or other stakeholders.

- Exit Strategy

- A clean and transparent cap table can mean the difference between an easy and a difficult exit. Mismanagement of equity can lead to disagreements that could potentially ruin acquisition deals.

Components of a Cap Table

A cap table typically includes a few key elements:

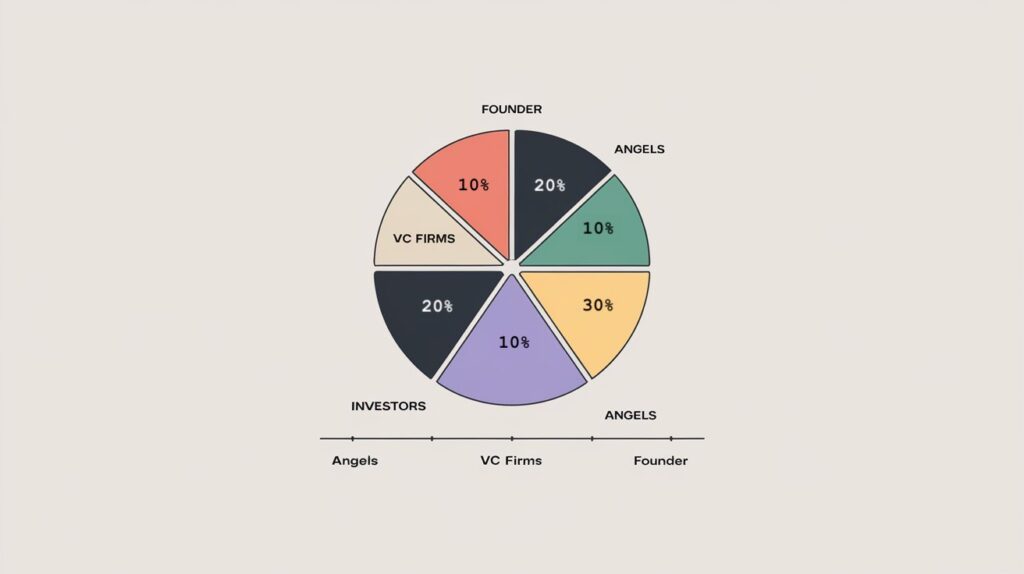

- Founders’ Equity: The shares allocated to the company founders.

- Investor Shares: Shares allocated to angel investors or venture capitalists.

- Employee Stock Options: A pool of shares reserved for future employees or advisors.

- Convertible Securities: Notes or SAFE agreements that will convert into equity in the future.

- Warrants: Rights to purchase shares at a specific price in the future.

Each of these plays a role in determining how ownership evolves over time, especially as new funding rounds are introduced.

Common Challenges in Managing a Cap Table

Managing a cap table is not as simple as it seems. Many founders encounter challenges that, if not handled properly, can have long-term negative consequences.

- Founder Dilution

- Every funding round introduces dilution. If founders aren’t careful, they may end up with a smaller slice of the pie than expected. For instance, after several rounds of investment, a founder may hold less than 10% of their company, losing both value and control.

- Complex Share Structures

- Some startups issue different types of shares—preferred shares, common shares, options, etc. This can complicate the cap table, especially if different investors have varying rights.

- Poor Record-Keeping

- Failing to maintain an updated cap table can lead to chaos, especially during due diligence by future investors or acquirers. A messy cap table raises red flags.

- Option Pool Shuffle

- Founders often forget to account for the employee stock option pool, which leads to additional dilution when they have to create or expand the pool in later funding rounds.

Case Study: How a Mismanaged Cap Table Can Derail a Company

A popular startup case shows the downside of neglecting cap table management. In the early 2010s, a fast-growing tech company raised several rounds of venture capital, but the founders neglected their cap table. After their Series C round, the founders realized they had diluted their ownership to just 8%, losing significant control. When they wanted to make major strategic decisions, they were blocked by investors who held the majority. A poorly managed cap table had left the founders with no voice in their own company.

Best Practices for Managing Your Cap Table

- Keep It Updated

- Your cap table is a living document. Every new hire, funding round, or issuance of convertible notes needs to be reflected.

- Understand Dilution

- Founders should run multiple dilution scenarios before entering any funding round. Knowing how future rounds will affect your ownership can prevent surprises.

- Use Software

- Plan Your Option Pool Early

- Before your first major funding round, set aside an employee stock option pool (usually around 10-20% of total shares). This helps avoid additional dilution surprises later on.

- Consult with Legal Advisors

- Your cap table is a legal document. Work closely with legal and financial advisors to ensure compliance and accuracy.

Frequently Asked Questions (FAQs) on Cap Tables

What’s the difference between common and preferred shares?

Founders and employees typically own common shares, while preferred shares are usually given to investors. Preferred shareholders often have rights like anti-dilution protection and liquidation preferences.

How does convertible debt affect my cap table?

Convertible debt doesn’t affect the cap table until it converts into equity, usually during a later funding round.

Can I modify the cap table after issuing shares?

Once shares are issued, they cannot be “unissued.” Any changes, such as issuing new shares or creating an option pool, must be accurately reflected in the cap table.

Recommended Books and Certifications

Books

- Venture Deals by Brad Feld and Jason Mendelson – A comprehensive guide to understanding cap tables and venture capital negotiations.

- The Art of Startup Fundraising by Alejandro Cremades – Offers insights into equity, dilution, and cap table management.

Courses

- Cap Tables 101 for Entrepreneurs and Investors (Udemy) – A hands-on course to understand and model Cap Table of a Startup.

- Y Combinator Startup School – Free resources on equity, dilution, and managing cap tables.

Certifications

- Certificate in Private Capital Markets (Pepperdine University) – Advanced insights into private equity, cap tables, and company valuations.

Key Takeaway

Maintaining control over your company requires effective management of your cap table. Don’t underestimate its importance. Keep it updated, understand the impact of dilution, and always consult with advisors to avoid common pitfalls. Your cap table can either be your best friend or your worst enemy as you scale your company.

Conclusion

In the fast-paced world of startups, founders often focus on product, growth, and raising capital. But behind the scenes, the cap table silently governs who owns what, and by extension, who calls the shots. Mismanagement can erode a founder’s stake in their own company, or worse, derail the company altogether. With the right approach, the cap table can become a tool for protecting the founder’s vision and ensuring future success.

Leave a Reply