- Home

- /

- Venture Capital

- /

- A Comprehensive Guide to Startup…

Introduction

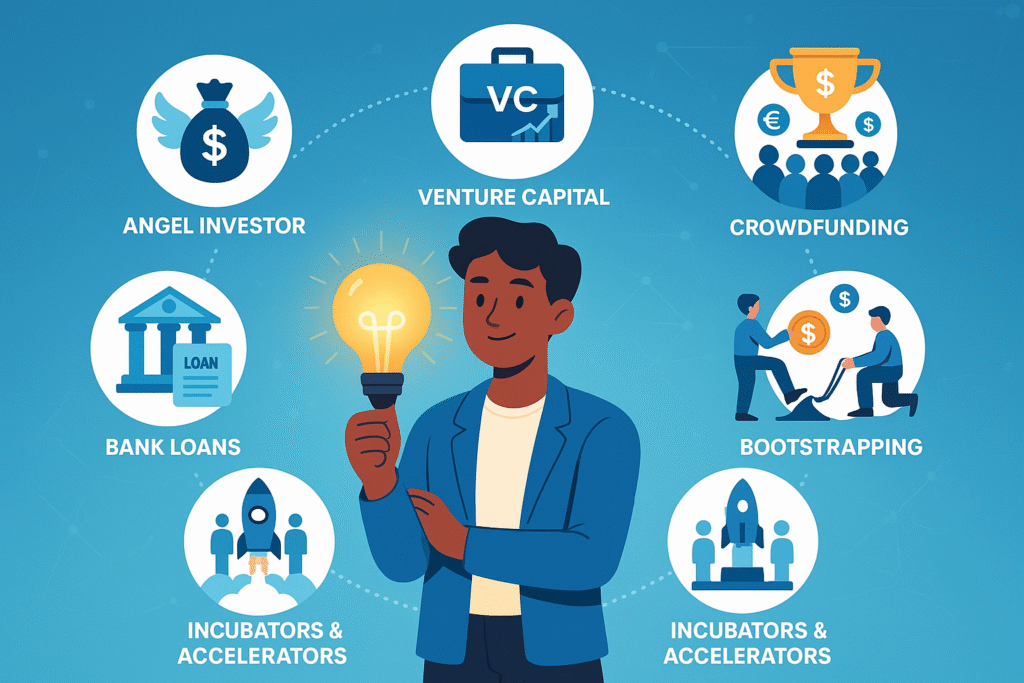

Starting a company is like setting sail on a wild, unpredictable ocean. You’ve got a vision, a talented crew, and maybe a prototype that’s got people buzzing. But to keep the ship moving, you need fuel, cash. Securing funding is one of the biggest hurdles founders face, and the choices you make can shape your startup’s future, for better or worse. As a venture capitalist who’s seen hundreds of pitch decks and sat through countless funding rounds, we’ve learned one thing: picking the right funding source is as critical as the idea itself. Get it wrong, and you’re giving away too much equity or drowning in debt. Get it right, and you’ve got the runway to scale, innovate, and maybe even disrupt an industry.

This article dives deep into the world of startup funding sources, breaking down the options, their pros and cons, and how they fit into different stages of a startup’s journey. From bootstrapping with your own savings to landing a Series A round with a top-tier VC, we’ll explore it all. We’ll throw in some real-world case studies, practical tips, recommended readings, and answers to FAQs to help you navigate this complex landscape. Let’s get started.

Why Funding Matters

Funding isn’t just about money, it’s about survival and growth. Most startups need capital to hire talent, develop products, or market their vision. Without it, even the best ideas can fizzle out. But funding comes at a cost. Equity rounds dilute your ownership, debt adds pressure, and every investor brings expectations. Choosing the right funding source depends on your startup’s stage, goals, and how much control you’re willing to share. Let’s break down the main funding options and when they make sense.

Funding Sources for Startups

Bootstrapping: Building from the Ground Up

Bootstrapping is when founders use personal savings, credit cards, or early revenue to fund their startup. It’s the ultimate “DIY” approach, no investors, no dilution, just you and your hustle.

Pros

- Full control: You own 100% of your company.

- No external pressure: No investors breathing down your neck.

- Forces discipline: Limited cash means you focus on what matters.

Cons

- Limited runway: Your savings can only go so far.

- Slow growth: Scaling takes longer without big capital injections.

- Personal risk: You’re betting your own money.

When to Use It: Bootstrapping works best for early-stage startups with low initial costs or founders who want to prove their concept before seeking external funds. It’s ideal for service-based businesses or software startups with minimal overhead.

Case Study – Basecamp: Basecamp, a project management software company, started as a bootstrapped venture. Founders Jason Fried and David Heinemeier Hansson used their own savings and revenue from consulting work to build the platform. By staying lean and focusing on profitability, they grew Basecamp into a multi-million-dollar business without taking a dime of outside funding. Their story shows that bootstrapping can work if you prioritize cash flow and customer traction.

Friends, Family, and “Fools”

This is often the first stop for external funding. You pitch to people who know you, friends, family, or early believers (sometimes called “fools” because they’re taking a big risk on an unproven idea).

Pros

- Easy access: They trust you, so it’s less formal.

- Flexible terms: Often interest-free loans or small equity stakes.

- Quick cash: Faster than pitching to VCs.

Cons

- Emotional risk: Mixing business with personal relationships can get messy.

- Limited funds: Most friends and family aren’t millionaires.

- Lack of expertise: They may not offer strategic guidance.

When to Use It: This is great for pre-seed stages when you need a small amount (think $10,000–$50,000) to build a prototype or test the market. Be clear about risks to avoid burning bridges.

Case Study – Oculus: Before becoming a VR giant acquired by Facebook for $2 billion, Oculus started with a $2.4 million Kickstarter campaign and early investments from friends and family. Founder Palmer Luckey leaned on his network to fund initial prototypes, proving the product’s potential before attracting big investors.

Crowdfunding: The Power of the Crowd

Crowdfunding platforms like Kickstarter, Indiegogo, and SeedInvest let you raise money from a large group of small investors, often in exchange for rewards or equity.

Pros

- Broad reach: Access thousands of potential backers.

- Market validation: A successful campaign shows demand.

- No immediate dilution: Reward-based crowdfunding doesn’t give away equity.

Cons

- Time-intensive: Campaigns require marketing and engagement.

- Fees: Platforms charge 5–10% of funds raised.

- Risk of failure: If you don’t meet your goal, you may get nothing (depending on the platform).

When to Use It: Crowdfunding shines for consumer products with a clear, tangible appeal, like gadgets, games, or creative projects. Equity crowdfunding suits startups ready to offer shares to non-accredited investors.

Case Study – Pebble: Pebble, a smartwatch pioneer, raised over $10 million on Kickstarter in 2012, shattering records at the time. The campaign validated their product and attracted VC attention, leading to further funding rounds before their eventual acquisition by Fitbit.

Angel Investors: Early Believers with Deep Pockets

Angel investors are wealthy individuals who invest their own money in startups, typically in exchange for equity or convertible notes. They often bring industry experience and networks.

Pros

- Mentorship: Many angels offer strategic advice.

- Flexible deals: Less rigid than VC terms.

- Faster decisions: Angels don’t need committee approvals.

Cons

- Dilution: You’re giving up equity early.

- Limited funds: Angels typically invest $25,000–$250,000.

- Varying expertise: Not all angels add value beyond cash.

When to Use It: Angel funding is ideal for seed-stage startups with a working prototype or early traction. Look for angels with industry expertise to maximize their value.

Case Study – Uber: Uber’s early days were fueled by angel investors, including First Round Capital and founder Garrett Camp’s own funds. These early bets helped Uber scale from a small app to a global giant, showing how angel funding can bridge the gap to VC rounds.

Venture Capital: The Big Leagues

Venture capital (VC) firms invest institutional money in startups with high growth potential, typically in exchange for significant equity (15–25% per round). VCs often take board seats and play an active role.

Pros

- Large sums: VCs can invest millions, enabling rapid scaling.

- Expertise and networks: Top VCs open doors to partners and talent.

- Credibility: VC backing signals market confidence.

Cons

- Heavy dilution: You give up a big chunk of ownership.

- Pressure to scale: VCs expect fast growth and exits.

- Loss of control: Board seats and voting rights shift power.

When to Use It: VC funding suits startups at the seed or Series A stage with proven traction and a clear path to scale. It’s best for tech-driven companies aiming for billion-dollar valuations.

Case Study – Airbnb: Airbnb raised $600,000 in its 2009 seed round from Sequoia Capital and Y Combinator. This VC cash helped them expand globally, proving that the right VC partner can supercharge growth. Today, Airbnb’s market cap exceeds $80 billion.

Venture Debt: Borrowing to Grow

Venture debt is a loan (often from specialized banks or funds) designed for startups with strong growth but limited cash flow. It usually comes with an equity kicker (a small equity stake) and interest rates of 8–12%.

Pros

- Less dilution: You give up less equity than in a VC round.

- Flexible use: Use the funds for equipment, marketing, or hiring.

- Extends runway: Buys time before the next equity round.

Cons

- Repayment pressure: Debt must be paid back, even if you’re not profitable.

- Equity kicker: You still give up some ownership.

- Risk of default: If cash flow dries up, you’re in trouble.

When to Use It: Venture debt works for startups with predictable revenue or recent VC funding, needing extra capital to bridge gaps or fuel growth without heavy dilution.

Case Study – Dropbox: Dropbox used venture debt in its early years to extend its runway after raising VC funds. This allowed them to scale infrastructure without further diluting equity, paving the way for their $10 billion valuation at IPO.

Private Equity: For Established Players

Private equity (PE) firms invest in mature startups or scaleups, often buying a controlling stake to optimize operations or merge companies for economies of scale.

Pros

- Large capital: PE firms can invest tens or hundreds of millions.

- Operational expertise: They help streamline businesses.

- Exit opportunities: PE often prepares companies for IPOs or acquisitions.

Cons

- Loss of control: PE firms often demand majority stakes.

- High expectations: They focus on profitability and efficiency.

- Not for early stages: PE rarely invests in pre-revenue startups.

When to Use It: PE is best for later-stage startups with positive cash flow and a clear path to profitability. It’s not for early-stage dreamers.

Case Study – Warby Parker: Warby Parker, the eyewear disruptor, took private equity funding from T. Rowe Price and others in later rounds to scale retail and operations. This helped them go public in 2021 at a $6 billion valuation.

Special Purpose Vehicles (SPVs): Pooling Investor Power

SPVs are legal entities created to pool money from multiple investors, allowing startups to raise funds from a group while keeping the cap table clean.

Pros

- Simplified cap table: One entity represents multiple investors.

- Access to diverse investors: Attracts smaller players who pool funds.

- Tax benefits: SPVs can offer tax advantages in some jurisdictions.

Cons

- Complexity: Setting up an SPV requires legal expertise.

- Fees: Managers of the SPV charge fees.

- Limited control: Investors in the SPV may have competing priorities.

When to Use It: SPVs are great for startups raising from a mix of angels or smaller funds, especially in seed or Series A rounds. They’re common in high-growth tech startups.

Case Study – SpaceX: SpaceX has used SPVs to raise funds from diverse investors, allowing Elon Musk to maintain a cleaner cap table while securing billions for rocket development.

Choosing the Right Funding Source

Picking the right funding source depends on your startup’s stage, industry, and goals. Here’s a quick guide:

- Pre-Seed (Idea Stage): Bootstrap, friends and family, or crowdfunding to build a prototype.

- Seed (Early Traction): Angels, crowdfunding, or early-stage VCs to refine your product.

- Series A and Beyond (Scaling): VCs, venture debt, or SPVs to fuel growth.

- Mature Stage (Profitability): Private equity for operational scaling or exits.

Pro Tip: Always simulate funding rounds to understand dilution and control. Tools like Capboard can help you model scenarios and keep your cap table clean.

Common Pitfalls to Avoid

- Giving Up Too Much Equity Early: Diluting 20–25% in a seed round can haunt you later. Negotiate hard and use tools like Capboard to model dilution.

- Ignoring the Cap Table: A messy cap table scares investors. Keep it digital and updated with platforms like Captable.io or Carta.

- Misaligned Investors: Choose investors who share your vision. A VC pushing for a quick exit might clash with your long-term goals.

- Over-Reliance on Debt: Venture debt is tempting but dangerous if your revenue isn’t stable.

- Poor Investor Communication: Regular updates build trust. Use platforms like Capboard to share professional reports.

Recommended Readings

- “Venture Deals” by Brad Feld and Jason Mendelson

A must-read for understanding VC term sheets, dilution, and negotiation tactics. - “The Lean Startup” by Eric Ries

Great for bootstrappers and early-stage founders focusing on efficient growth. - “The Art of Startup Fundraising” by Alejandro Cremades

A step-by-step guide to pitching investors and closing rounds.

FAQs

Q: How much equity should I give up in a seed round?

A: Typically, 15–25% per round is standard, but it depends on valuation and investor demands. Use a dilution calculator to model scenarios.

Q: Is crowdfunding a good option for tech startups?

A: It works best for consumer products with mass appeal. Tech startups may struggle unless they have a tangible prototype to showcase.

Q: When should I consider venture debt?

A: Use venture debt after a VC round to extend your runway or fund specific projects, but ensure you have revenue to cover repayments.

Q: How do I keep my cap table organized?

A: Use digital tools like Capboard to track shares, vesting schedules, and funding rounds. Avoid Excel to prevent errors.

Q: What’s the difference between angel investors and VCs?

A: Angels are individuals investing personal money, often in smaller amounts ($25K–$250K), while VCs manage institutional funds and invest millions but demand more control.

Conclusion

Funding a startup is a high-stakes game, but with the right strategy, it’s a game you can win. Whether you’re scraping by with personal savings, pitching to angels, or negotiating with VCs, each funding source has its place in your journey. The key is to understand your options, model the outcomes, and align with investors who believe in your vision. Tools like Capboard can simplify cap table management and funding simulations, giving you clarity and control.

We’ve seen founders make costly mistakes, giving up too much equity, picking the wrong investors, or neglecting their cap table. But we’ve also seen startups thrive by making smart, informed choices. Take the time to research, simulate, and negotiate. Your startup’s future depends on it. Now go out there, pitch with confidence, and build something extraordinary.

Enjoyed this article? Dive deeper into venture capital with our detailed guide. Check it out here. Plus, explore our curated resources on venture capital right here.

Leave a Reply