- Home

- /

- Venture Capital

- /

- Bill Ackman: The Fearless Investor…

Introduction

Imagine waking up to find your bank account has more than doubled overnight. For Bill Ackman, that is not just a dream; it is reality. In 2025, the hedge fund titan saw his net worth rocket from $4.3 billion to $9.2 billion, thanks to a string of savvy moves that left the market buzzing. As the founder of Pershing Square Capital Management, Ackman has always played the long game with high stakes. This year, his flagship fund crushed the S&P 500, returning 25.3 percent while the index lagged at 11.7 percent. What fuels this relentless drive? A mix of sharp instincts, unyielding conviction, and a knack for spotting opportunities others miss. Let us dive into the story of Bill Ackman, the man who turns Wall Street into his personal chessboard.

From Harvard Halls to Wall Street Warrior

Bill Ackman did not stumble into billions by accident. Born in 1966 in Chappaqua, New York, he grew up in a family that valued smarts and hustle. His father ran a real estate firm, planting early seeds of deal-making savvy. Ackman breezed through Harvard College, graduating magna cum laude in 1988, then doubled down with an MBA from Harvard Business School in 1992. Those ivy-covered walls sharpened his mind, but it was the cutthroat world of finance that forged his edge.

Right out of school, Ackman co-founded Gotham Partners in 1992, a firm blending public and private equity. It showed promise, but regulatory hurdles forced it to shut down in 2003. Undeterred, he launched Pershing Square Capital Management the next year with a simple pitch: invest big in undervalued companies and push for change. Today, that bet manages around $20 billion in assets. Ackman is no armchair investor. He is an activist, the kind who storms boardrooms and rallies shareholders to shake things up. Think of him as the gadfly of global markets, stinging complacency wherever he finds it.

The Ackman Playbook: Concentrated Bets on Durable Winners

Ackman is not chasing shiny trends. His style is laser-focused, often pinning half his portfolio on just a handful of picks. Forget diversification for its own sake, he says. Go all in on what you know cold. Over the years, he has ditched the short-selling drama, the bets against failing firms that once defined him. Now, it is all about “durable growth companies,” outfits built to last through storms.

Take Pershing Square Holdings, his London-listed closed-end fund trading as PSHZF on U.S. over-the-counter markets. Its net asset value sits at about $16 billion, though the market prices it closer to $11 billion. That gap? Ackman sees it as a bargain for patient buyers. His latest 13F filing reveals a portfolio worth $13.8 billion, with 58 percent jammed into three heavyweights. It is a high-wire act, sure, but one that has paid off handsomely this year.

Housing Heroes: How Fannie Mae and Freddie Mac Supercharged 2025

Nothing captures Ackman’s genius quite like his mortgage gambit. For years, he has banged the drum to free Fannie Mae and Freddie Mac from government conservatorship, a holdover from the 2008 crash. Enter the Trump administration in 2025, and suddenly, investors smell reform. Shares exploded. Fannie Mae, starting the year around $3, closed a recent Friday at $14.64, a 350 percent leap. Freddie Mac mirrored the surge, hitting $13.50 after a 300 percent run, up from similar lows.

Pershing Square holds an estimated 180 million shares combined, including 115 million of Fannie Mae. That stake? Now worth nearly $2.5 billion, the fund made about $2 billion in pure profit this year alone. Ackman is no small player here, one of the biggest owners pushing for privatization. Critics call it speculative, but results do not lie. In a world of shaky housing markets, Ackman bet on stability, and Washington is delivering.

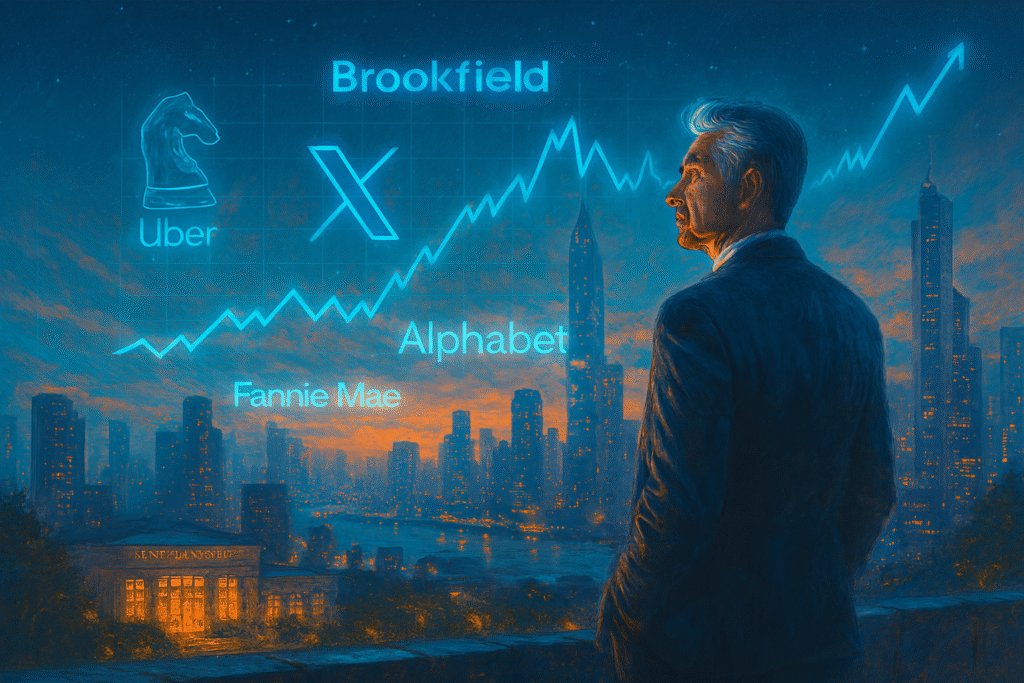

Power Plays: Uber, Brookfield, and Alphabet Lead the Charge

Ackman’s portfolio reads like a who’s who of tomorrow’s winners. Dive into that top trio, and you see why.

Start with Uber Technologies, gobbling 20.6 percent of the pot. Ackman piled in early 2025 with 30.3 million shares, turning it into his crown jewel. The stock is up 57 percent year-to-date, fueled by 180 million users and 35 percent adjusted EBITDA growth. Sure, self-driving cars loom large, but Ackman views them as allies. Uber is a network, the glue connecting riders to wheels. Partnerships with Waymo and others? That is his moat. At 3.9 times forward revenue, it feels like a steal for the ride-hailing giant.

Then there is Brookfield Corp, at 19.7 percent. Ackman built this stake over five quarters, starting in mid-2024. The asset manager is churning 13 percent distributable earnings growth, with eyes on 21 percent annually through 2029. Its Wealth Solutions arm ballooned insurance assets to $135 billion, up from $45 billion two years back. By decade’s end, it could top $300 billion. Trading below 20 times 2025 earnings, Brookfield screams value in a frothy market.

Rounding out the trio is Alphabet, claiming 17.9 percent. Ackman scooped shares in 2023, betting AI hype had tanked the price unfairly. He trimmed in 2024 but reloaded in 2025, favoring voting Class A stock. Google Search grew 12 percent last quarter, infused with AI tricks like Overviews and Lens. Cloud sales? Up 32 percent, margins at 22 percent. Regulatory clouds hang, with monopoly probes possibly forcing divestitures. Yet at under 21 times forward earnings, the lowest among tech titans, it is a bargain for the AI powerhouse.

Other staples round out the mix: Restaurant Brands International, Canadian Pacific Railway, and Chipotle Mexican Grill. These are not fads; they are fortresses.

Bold Strokes and Bruising Battles: Ackman is a Rollercoaster Ride

Ackman’s career is a highlight reel of gutsy calls. Remember 2020? He shorted credit markets pre-COVID, pocketing $2.6 billion as chaos hit. That war chest funded buys in Chipotle and Canadian Pacific, both multibaggers still anchoring the fund. Earlier, he rescued General Growth Properties from bankruptcy in the financial crisis, a move that saved malls and minted millions.

Not every swing connects. His short on MBIA dragged on for years, a public spectacle. Valeant Pharmaceuticals? A $4 billion wipeout that tested his resolve. Yet Ackman bounces back, turning scars into strategy. He founded Pershing Square in 2004 amid those Gotham ashes, proving resilience is his real superpower.

The Megaphone: Politics, Pushback, and Public Scrutiny

Wall Street suits do not make Ackman tick alone. With over 2 million followers on X, he wields influence like a weapon. In 2024, he led the charge against Harvard president Claudine Gay, citing plagiarism and antisemitism concerns. She resigned in January, a win for his crusade. That same year, he flipped the script, endorsing Donald Trump after lifelong Democratic leanings. It raised eyebrows, but aligned with his push for Fannie and Freddie reform.

Lately, shadows crept in. Following the assassination of Charlie Kirk in September 2025, commentator Candace Owens alleged a tense Hamptons meeting involving Ackman, Kirk, and others, claiming threats over Israel stances. Ackman fired back on X, calling it “completely untrue” and defamatory. No evidence has surfaced, but it underscores the heat his voice draws. Ackman does not shy from fights; he thrives in them.

Heart on the Balance Sheet: Philanthropy and Beyond

Behind the bravado lies a giver. In 2006, Ackman started the Pershing Square Foundation, funneling millions into education, health, human rights, and social justice. He joined The Giving Pledge, vowing half his wealth to causes. It is not show, it is substance, a counterweight to the deal-making grind.

Recommended Readings

For anyone inspired by Ackman’s activist spirit, these investing classics offer timeless wisdom:

- “The Intelligent Investor“ by Benjamin Graham: The bible of value investing, emphasizing discipline over hype.

- “Barbarians at the Gate“ by Bryan Burrough and John Helyar: A gripping tale of corporate raids, echoing Ackman’s bold style.

- “The Outsiders” by William N. Thorndike: Profiles CEOs like Ackman, who master capital allocation for outsized returns.

FAQ

Q1: Why did Bill Ackman’s net worth double in 2025?

A: His hedge fund, Pershing Square, posted stellar returns, especially from massive gains in Fannie Mae and Freddie Mac shares amid reform hopes.

Q2: What is Bill Ackman’s biggest investment right now?

A: Uber Technologies tops the list at over 20 percent of its U.S. portfolio, followed closely by Brookfield and Alphabet.

Q3: Has Bill Ackman always been a long-term investor?

A: No, he made his name with shorts like MBIA and a huge COVID hedge, but now focuses on growth stocks he believes in forever.

Q4: What controversies surround Bill Ackman?

A: He has clashed over Harvard leadership, endorsed Trump unexpectedly, and recently denied claims tied to Charlie Kirk’s death.

Q5: How does Ackman give back?

A: Through the Pershing Square Foundation and The Giving Pledge, supporting education, health, and justice initiatives.

Wrapping Up: Ackman is Next Chapter

Bill Ackman stands at a pinnacle in 2025, his fortune swelled by bets that blend brains and bravery. From Harvard dreamer to billionaire brawler, he reminds us that investing is as much art as math. As markets shift and politics simmer, expect Ackman to keep stirring the pot. His lesson? Conviction pays, but only if you are willing to stand alone. In a noisy world, that is the quiet edge.

Leave a Reply