Introduction

Picture this: It’s a crisp Friday morning in September 2025, and the Nasdaq floor hums with anticipation. Then, bam, Gemini Space Station, the brainchild of the infamous Winklevoss twins, bursts onto the scene under the ticker GEMI. Shares priced at $28 skyrocket to $37 on open, touch $45.89 midday, and settle with a solid 14% gain. For a sector still shaking off regulatory jitters and market slumps, this Gemini IPO feels like a shot of adrenaline. It’s not just another listing; it’s a vote of confidence in compliant crypto plays, a nod to institutional hunger, and a reminder that the Winklevoss brothers are still swinging for the fences. In this deep dive, we’ll unpack the numbers, the strategy, and what it all means for traders eyeing the next big wave.

The Winklevoss Legacy: From Facebook Feud to Crypto Pioneers

Cameron and Tyler Winklevoss didn’t stumble into crypto; they charged in. Remember The Social Network? Those rowers who sued Mark Zuckerberg for stealing their idea? Yeah, that’s them. After pocketing a $65 million settlement in 2011, the twins funneled it straight into Bitcoin, becoming some of the first crypto billionaires. Fast forward to 2014: Frustrated with shady exchanges riddled with hacks and opacity, they launched Gemini as a beacon of trust in a Wild West industry.

Today, Gemini stands out as a U.S.-based powerhouse, regulated as a trust company in New York, the strictest crypto regime in the country. It’s more than a spot to swap tokens; think of it as a Swiss Army knife for digital assets. Users get seamless fiat on-ramps, a dollar-pegged stablecoin called GUSD, staking rewards that mimic yields without the hassle, and even a credit card dishing out crypto back on everyday spends. For big players, there’s institutional custody safeguarding billions. With over 700 employees worldwide and 1.5 million lifetime users, Gemini has quietly built a moat around compliance and security, trading blows with giants like Coinbase while carving its niche.

Building Hype: The IPO Journey and Sky-High Demand

Gemini’s path to public markets wasn’t a straight shot. Filing an S-1 with the SEC in early 2025, the company teased a “super app” vision blending tradfi tools with blockchain magic, AI-driven portfolios, tokenization of real-world assets, and one-stop crypto payments. But the real fireworks started when demand exploded.

Initial pricing chatter hovered at $17 to $19 per share. Then, whispers of frenzy hit: Orders poured in at 20 times the supply, forcing underwriters Goldman Sachs and Citigroup to slam the order book shut early. Gemini’s leadership, ever the strategists, capped the raise at $425 million, a move that screamed scarcity in a market used to endless dilution. They trimmed shares from 16.67 million to 15.1 million Class A, pricing at a juicy $28, well above the revised $24 to $26 range.

Adding star power, Nasdaq itself chipped in $50 million via private placement, signaling deep-pocketed validation. This wasn’t just cash; it was a halo effect, tying Gemini to the exchange’s ecosystem. For context, that’s on top of the public float, pushing total proceeds north of $475 million. In a year stacked with tech debuts like Klarna’s buy-now-pay-later splash, Gemini’s restraint paid off, setting the stage for a valuation north of $3.3 billion.

Debut Day Rollercoaster: Pops, Peaks, and Post-IPO Reality

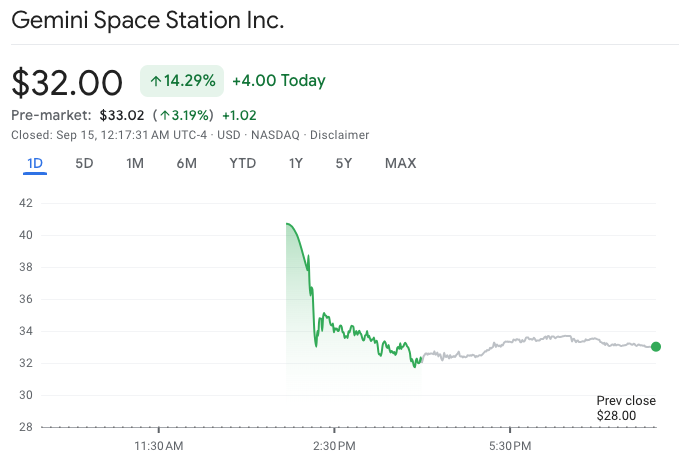

September 12, 2025, delivered theater. GEMI opened at $37.01, a 32% pop, fueled by retail frenzy and institutional FOMO. Traders piled in, driving it to $45.89 before profit-taking kicked in. By close, it hovered around $32, up 14% from pricing. Volume surged, with sympathy plays rippling through peers: Coinbase ticked up 3%, Circle’s stablecoin outfit gained 5%.

Why the heat? Crypto’s rebounding. Bitcoin ETFs have mainstreamed the asset class, and a friendlier regulatory breeze under the Trump administration, remember the twins’ early ETF push in 2013? has thawed Wall Street’s frostbite. Gemini’s clean books and focus on tokenization tapped into that narrative, positioning it as the “grown-up” exchange for a maturing market.

But let’s not sugarcoat: Day two brought a 2% dip as reality bit. Traders eyed the 20x oversubscription as a classic IPO sugar rush, wondering if the bid holds.

Crunching the Numbers: Gemini’s Balance Sheet Breakdown

Transparency’s Gemini’s calling card, and the prospectus didn’t disappoint. As of July 2025, the platform custodied over $21 billion in assets, a hefty war chest amid crypto’s $2 trillion total market cap. Lifetime transfers? A whopping $830 billion. And those credit cards? Over 70,000 issued, each earning users crypto rewards on swipes.

Revenue’s climbing: $98.1 million in 2023, jumping to $142.2 million in 2024, mostly from trading fees. Yet losses linger, $319.7 million net red ink in 2023, narrowing to $158.5 million last year. First-half 2025? Another $283 million hit, blamed on expansion bets and a bearish crypto winter. As an “emerging growth company,” Gemini leans on lighter disclosures, but skeptics note flat trading volumes versus Coinbase’s dominance.

Still, metrics shine: Modest compared to Binance’s stablecoin hoard (67% market share), but Gemini’s compliance edge could unlock institutional flows as regs tighten.

Charting the Future: Tokenization, Payments, and the Super App Bet

Gemini’s not content as a trading pit. The IPO docs paint a bold roadmap: Heavy on asset tokenization, turning real estate or art into blockchain bites, and crypto payments via that rewards card. It’s chasing a “super app” dream, fusing wallets, AI analytics, and fiat bridges under one roof. Leaders tout untapped potential here, eyeing consumer tools to snag everyday users beyond die-hard traders.

Partnerships amplify this. Ties to Nasdaq bolster tech cred, while New York BitLicense status wards off FTX-style meltdowns. In a sector pivoting from speculation to utility, Gemini’s play feels prescient, especially with rivals like Kraken and Bullish nipping at its heels.

Retail’s Big Swing: 30% Allocation and the Democratization Push

One IPO twist stole the show: Up to 30% of shares were earmarked for retail via platforms like Robinhood, Moomoo, and Webull. That’s double the initial 10-15% plan, a savvy nod to crypto’s grassroots army. But catch: Anti-flipping clauses lock sales for a month, curbing quick flips but rewarding holders.

Experts like Georgetown’s James Angel call it smart, crypto fans stickier than hedge funds dumping on dips. Yet caveats abound: Retail often overpays in hot IPOs, and Gemini’s “second-tier” status (per some analysts) raises adverse selection flags. Bullish allocated 20% retail and soared 84% on debut (before cooling); Robinhood’s 35% in 2021? A meme-stock legend with brutal drawdowns. For Gemini, it’s a high-wire act balancing enthusiasm with execution.

Crypto’s IPO Renaissance: Gemini in the Pack

Gemini’s timing is impeccable. 2025’s a banner year: eToro debuted in March (down 14% since), Circle hit NYSE in June (up 93%), Bullish followed in August (down 43%). This wave screams legitimacy; once fringe, crypto firms now court billions from public taps. Gemini joins as a compliant outlier, its Nasdaq nod echoing Coinbase’s 2021 trailblaze.

Broader trends fuel it: Bitcoin’s ETF glow, Solana/XRP ETF chatter, and Chainlink/Polymarket innovations blurring tradfi lines. Tony Edwards, a sharp crypto voice, flags Gemini alongside Tether’s USAT stablecoin as finance-digitization harbingers.

Treading Carefully: Risks That Could Derail the Rally

No fairy tale here. Crypto’s volatile, regulatory whiplash, like SEC fraud probes, looms large. Gemini’s losses signal profitability hurdles; trading volumes lag Coinbase, and competition is fierce. Tokenization’s promising but unproven at scale. Plus, that 20x demand? It could flip to apathy if Bitcoin stumbles.

Traders, take note: Sympathy plays abound, but diversify. Institutional appetite’s real, yet tolerance for red ink wanes.

Recommended Readings

For deeper dives into crypto’s wild ride, grab these timeless books:

- “The Bitcoin Standard“ by Saifedean Ammous: A gripping case for Bitcoin as the ultimate money.

- “Cryptoassets: The Innovative Investor’s Guide to Bitcoin and Beyond“ by Chris Burniske and Jack Tatar: A Practical playbook for valuing digital gold.

- “Kings of Crypto: One Startup’s Quest to Take Cryptocurrency Out of Silicon Valley and Onto Wall Street“ by Jeff John Roberts: Inside the exchange wars, with Gemini cameos.

- “The Age of Cryptocurrency: How Bitcoin and the Blockchain Are Challenging the Global Economic Order“ by Paul Vigna and Michael J. Casey: Big-picture on why IPOs like Gemini’s matter.

FAQ: Your Gemini IPO Questions Answered

Q1: What exactly is the Gemini IPO, and when did it happen?

A: The Gemini IPO marked the public debut of Gemini Space Station, the Winklevoss twins’ crypto exchange, on September 12, 2025, raising $425 million at $28 per share on Nasdaq under GEMI.

Q2: How did Gemini’s stock perform on its first trading day?

A: It opened at $37.01 (up 32%), peaked at $45.89, and closed around $32, a 14% gain from pricing, amid massive 20x oversubscription.

Q3: Is Gemini profitable yet?

A: Not quite, 2024 revenue hit $142.2 million, but net losses clocked $158.5 million. The company bets on growth in payments and tokenization to turn the tide.

Q4: Why did Gemini cap its IPO at $425 million?

A: To foster scarcity and potentially boost post-IPO performance, despite demand allowing more. It reduced shares offered to hit that limit.

Q5: How does Gemini stack up against Coinbase or Circle?

A: Smaller scale (volumes and users), but stronger on compliance. Circle’s up 93% post-IPO; Coinbase leads trading but faces similar loss pressures.

Q6: Should retail investors jump in now?

A: With 30% allocated to platforms like Robinhood, it’s accessible, but anti-flipping rules apply, and crypto volatility demands caution.

Wrapping It Up: A Launchpad for Crypto’s Next Act

The Gemini IPO isn’t just a win for the Winklevoss twins; it’s a milestone for an industry clawing toward maturity. That $425 million haul, 32% debut pop, and $3.3 billion valuation underscore investor faith in regulated rails amid chaos. Sure, bumps lie ahead: Losses to plug, regs to navigate, volumes to chase. But with tokenization on deck and retail roaring, Gemini’s primed to bridge crypto’s gap to Main Street. For investors, it’s a tantalizing bet, high risk, higher reward in a sector that’s anything but boring. Keep GEMI on watch; this rocket’s just igniting.

Leave a Reply