- Home

- /

- Venture Capital

- /

- Jared Kushner’s Audacious Gaming Gambit:…

Introduction

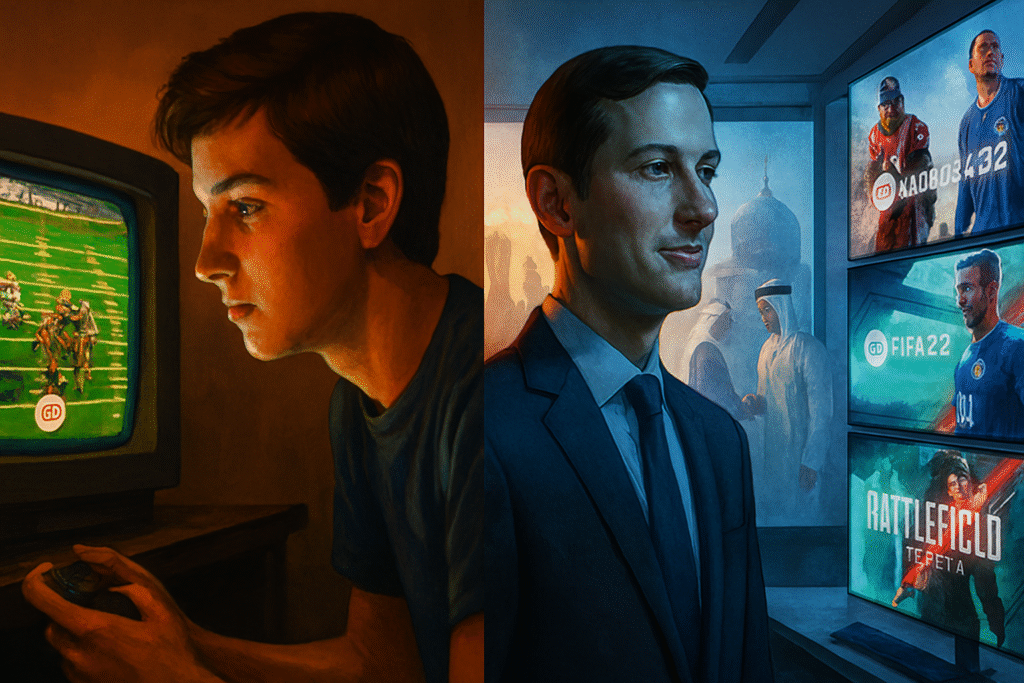

Imagine a former White House advisor, once knee-deep in Middle East diplomacy, now channeling his deal-making savvy into the pixelated world of video games. That’s Jared Kushner for you. In a move that’s equal parts bold and eyebrow-raising, Kushner’s investment firm, Affinity Partners, has joined forces with Saudi Arabia’s deep-pocketed sovereign wealth fund and a tech-savvy private equity giant to snap up Electronic Arts, the powerhouse behind franchises like Madden and The Sims. Valued at a staggering $55 billion, this deal isn’t just reshaping the gaming landscape; it’s a window into how global money flows are rewriting the rules of entertainment. Let’s dive into what this means for Kushner, EA, and the industry at large.

Who Is Jared Kushner, and Why Gaming Now?

Jared Kushner might be best known for his role in the Trump administration, where he brokered historic Abraham Accords and navigated the complexities of U.S.-Saudi relations. But since leaving Washington, he’s pivoted to the private sector with Affinity Partners, a firm he launched in 2021 to chase opportunities in emerging markets and high-growth sectors. Backed by a hefty $2 billion from Saudi Arabia’s Public Investment Fund (PIF), Affinity has quietly built a portfolio that blends real estate roots with fresh bets on tech and media.

This EA play marks Affinity’s biggest splash in gaming yet. Kushner, a self-professed fan who grew up glued to EA titles and now shares them with his kids, sees the company as more than a nostalgia trip. “I’ve admired EA’s ability to create iconic, lasting experiences,” he said in a statement that feels both personal and calculated. It’s a savvy entry point for a firm still proving its mettle outside the political spotlight. With Affinity’s Saudi ties front and center, this deal underscores Kushner’s knack for leveraging connections forged in the corridors of power.

The Mechanics of the Monster Deal

At its core, this is a leveraged buyout designed to take EA private after 36 years on the public markets. The consortium, PIF as the anchor, Silver Lake providing the private equity muscle, and Affinity rounding out the trio, has agreed to pay EA shareholders $210 per share, pushing the total enterprise value to $55 billion. That’s $36 billion in fresh equity from the buyers, topped off with $20 billion in debt financing to make it happen.

PIF, already holding a 9.9% stake in EA, is rolling that over into the new structure, cementing its role as the lead investor. Silver Lake brings gaming cred through its stake in Unity and experience steering tech turnarounds, its managing partner Jim Whitehurst even chaired Unity’s board after a CEO shakeup. The group expects to seal the deal by the first quarter of fiscal 2027, pending nods from shareholders and U.S. national security regulators, given the foreign investment angle.

For EA, it’s a chance to escape quarterly earnings pressure and double down on long-term plays like the upcoming EA Sports FC 26 and Battlefield 6. CEO Andrew Wilson is sticking around, and the Redwood City headquarters isn’t going anywhere. Wilson called it “one of the largest investments ever in the entertainment industry,” praising the buyers’ blend of sports, gaming, and global expertise. Still, whispers of cost-cutting loom large, $20 billion in debt could mean tough choices, including layoffs in an industry already reeling from post-pandemic adjustments.

Kushner’s Personal Stake in the Game

What draws Kushner to this? Beyond the fanboy appeal, it’s a calculated expansion for Affinity. The firm, with its PIF lifeline, has eyed entertainment as a growth engine, and EA fits like a glove: a cash cow with 14,500 employees and a library of evergreen hits. Kushner’s involvement adds a layer of intrigue, his Middle East dealings helped secure PIF’s initial backing for Affinity, and now they’re teaming up again on U.S. soil.

Critics point to potential conflicts, given Kushner’s family ties to Trump and the optics of Saudi money flowing into American icons. Yet Kushner frames it as pure opportunity: a way to fuel innovation without Wall Street’s short-term gaze. Analysts are split. Mike Hickey at The Benchmark Company calls it an “opportunistic move” that might undervalue EA’s pipeline, while Nick McKay from Freedom Capital Markets sees it unlocking “long-term growth without public market pressures.” Either way, it’s Kushner’s boldest post-White House flex.

Saudi Influence in Silicon Valley: A Double-Edged Sword

PIF’s role here isn’t isolated. Over the past four years, Saudi Arabia has poured billions into gaming, from esports arenas in Riyadh to stakes in studios like Steer Studios. PIF’s head of international investments, Turqi Alnowaiser, promises to “drive industry-wide progress” without meddling in day-to-day ops. But that assurance rings hollow for some, especially amid Saudi Arabia’s human rights scrutiny, think restrictions on women’s rights and LGBTQ+ communities, issues that clash with gaming’s diverse fanbase.

EA employees have voiced unease, with one telling reporters the deal feels misaligned with the company’s progressive ethos. PIF counters by highlighting non-interference pledges, but history (like Saudi sports-washing in golf and boxing) fuels skepticism. For Kushner, navigating this tightrope could define Affinity’s trajectory, proving he can blend Eastern capital with Western creativity without backlash.

What This Means for Gamers and the Industry

Going private could supercharge EA’s R&D, letting it chase ambitious projects like live-service expansions or VR integrations without investor jitters. But it also risks homogenization if debt servicing trumps bold risks. The gaming sector, still buzzing from hits like EA Sports FC 25 at Gamescom, stands to gain from PIF’s global push, potentially funding more cross-cultural titles. Yet the influx of sovereign cash raises questions: Will it dilute creative freedom, or ignite a new era of innovation?

Recommended Readings

To deepen your understanding of the intersections between politics, money, and media, here are a few standout books:

- “Kushner, Inc.: Greed. Ambition. Corruption. The Extraordinary Story of Jared Kushner’s Real Estate Empire“ by Vicky Ward – A gritty look at Kushner’s pre-White House world.

- “Console Wars: Sega, Nintendo, and the Battle that Defined a Generation“ by Blake J. Harris – Captures the cutthroat drama of gaming’s rise.

- “The King of Content: A Biography of Howard Hughes“ by Michael Hackworth – Explores visionary deal-making in entertainment, echoing modern moguls like Kushner.

- “Extra Lives: Why Video Games Matter“ by Tom Bissell – A thoughtful dive into gaming’s cultural punch.

FAQ

Q1: How much is Jared Kushner investing in the EA deal through Affinity Partners?

A: Specific figures for Affinity’s stake aren’t public, but it’s part of a $36 billion equity pool led by PIF. The total deal hits $55 billion with debt.

Q2: Will EA’s popular games like Madden change under new ownership?

A: No major shifts are announced. The focus is on growth, with CEO Andrew Wilson staying on to guide creative direction.

Q3: Why is Saudi Arabia’s PIF involved in U.S. gaming?

A: PIF sees gaming as a high-growth sector for diversification, much like its moves in sports and tech. It already owned nearly 10% of EA.

Q4: Could this deal face regulatory hurdles?

A: Yes, U.S. national security reviews are likely due to PIF’s foreign ties, but the group expects approval by early 2027.

Q5: Is this Kushner’s first gaming investment?

A: It’s Affinity’s largest, but the firm has dipped into entertainment; this one stands out for its scale and high-profile partners.

Wrapping Up: Kushner’s Next Level Up

Jared Kushner’s leap into the EA deal is more than a transaction; it’s a statement. From Oval Office strategist to gaming investor, he’s betting big on entertainment’s future, tethered to Saudi visionaries and private equity pros. At $55 billion, this could etch his name in buyout lore, but success hinges on balancing profits with the soul of play. As EA trades its ticker for private horizons, one thing’s clear: Kushner isn’t done disrupting. Watch this space, the next boss level might just be his.

Leave a Reply