- Home

- /

- Venture Capital

- /

- Saks Global’s Strategic Shift: Inside…

Introduction

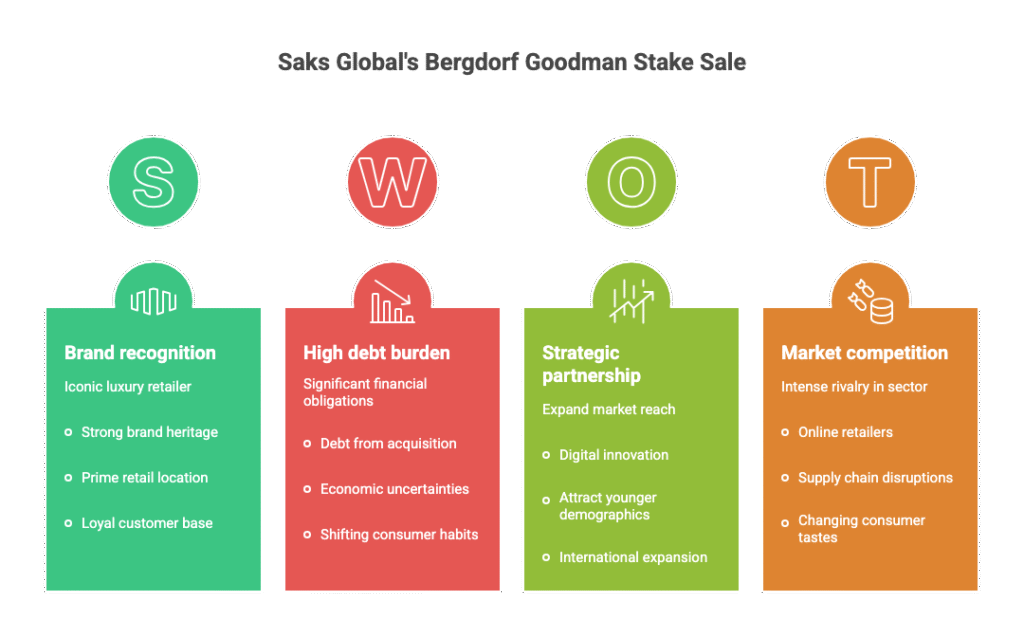

In the fast-paced world of luxury retail, where iconic brands often blend tradition with modern business strategies, a major development is unfolding. Saks Global, the powerhouse behind Saks Fifth Avenue, is reportedly in discussions to sell a minority stake in the legendary Bergdorf Goodman department store. This move could fetch around $1 billion and signals a fresh approach to managing debt while unlocking value in a competitive market. As shoppers and investors alike watch closely, this potential deal highlights the evolving dynamics of high-end shopping in an era of mergers and economic pressures.

The Rise of Saks Global

To understand this latest chapter, it’s helpful to look back at how Saks Global came to be. The company was formed in July 2024 when Hudson’s Bay Company, or HBC, completed its $2.65 billion acquisition of Neiman Marcus Group. This merger brought together some of the most prestigious names in luxury retail, including Saks Fifth Avenue, Neiman Marcus, and Bergdorf Goodman, along with valuable real estate holdings. The result was Saks Global, a unified entity aimed at strengthening its position against rivals like Nordstrom and Bloomingdale’s in a sector facing challenges from online competitors and shifting consumer habits.

Bergdorf Goodman itself has a storied history. Founded in 1899 by Herman Bergdorf and Edwin Goodman, the store has long been a New York City landmark on Fifth Avenue, known for its curated selection of designer fashion, jewelry, and home goods. It became part of the Neiman Marcus family in 1972, and its reputation for personalized service and exclusive offerings has made it a favorite among affluent shoppers. Today, under Saks Global, it continues to embody old-world elegance while adapting to digital trends.

Details of the Proposed Deal

According to recent reports, Saks Global is negotiating the sale of a 49 percent stake in Bergdorf Goodman for approximately $1 billion. This would value the entire retailer somewhere between $1.5 billion and $2.5 billion, a figure that reflects its premium status in the luxury space. The deal structure keeps Saks Global in majority control, allowing it to retain operational oversight while bringing in fresh capital from an outside investor.

At least four parties have shown interest, creating a competitive bidding environment. These include sovereign wealth funds from the Middle East, which have increasingly invested in Western retail and lifestyle brands, as well as strategic investors who might see synergies with their existing portfolios. If all goes as planned, the transaction could close in early 2026, providing a timely boost to Saks Global’s financial position.

Why Pursue This Sale Now?

The primary driver appears to be debt management. The acquisition of Neiman Marcus saddled Saks Global with significant borrowings, and the proceeds from this stake sale would directly help reduce that load. This isn’t an isolated effort; the company is also actively selling off about $600 million in real estate assets from its portfolio, which is valued at roughly $9 billion overall. These steps suggest a broader strategy to streamline operations and focus on core retail strengths amid economic uncertainties, including inflation and cautious spending by high-net-worth individuals.

Luxury retail has faced headwinds in recent years, from supply chain disruptions to the rise of e-commerce giants like Amazon and Farfetch. By partnering with an investor, Saks Global could gain not just funds but also expertise or international reach, potentially expanding Bergdorf Goodman’s footprint beyond its Manhattan flagship.

Potential Impacts on the Industry

If the deal materializes, it could set a precedent for other luxury conglomerates. Minority stake sales allow brands to maintain their identity while accessing capital, a tactic seen in deals involving names like Gucci or Louis Vuitton under larger groups. For Bergdorf Goodman, this might mean enhanced marketing, digital innovations, or even new store concepts to attract younger demographics like millennials and Gen Z, who prioritize experiences over traditional shopping.

On a larger scale, this reflects the consolidation trend in retail. Mergers like Saks and Neiman aim to create economies of scale, better negotiate with suppliers, and invest in technology. However, they also raise questions about preserving brand uniqueness. Will Bergdorf’s distinct charm endure under shared ownership?

Recommended Readings

For those interested in the world of luxury retail and its business intricacies, consider these books:

- “Deluxe: How Luxury Lost Its Luster” by Dana Thomas – A deep dive into the evolution of luxury brands and the challenges they face in maintaining exclusivity.

- “Luxury: A Rich History” by Christopher Berry and Hannah Lyons – An exploration of luxury’s cultural and economic history, from ancient times to modern markets.

- “The New Luxury: Defining the Aspirational in the Age of Hype” by Gestalten – Insights into how contemporary consumers view and engage with high-end goods.

FAQ

Q1: What is Saks Global?

A: Saks Global is the parent company formed in 2024 through the merger of Saks Fifth Avenue and Neiman Marcus Group, owned by Hudson’s Bay Company. It oversees a portfolio of luxury retail brands and real estate.

Q2: Why is Saks Global selling a stake in Bergdorf Goodman?

A: The main goal is to raise funds to pay down debt from the Neiman Marcus acquisition. It also aims to unlock value in the brand while keeping majority control.

Q3: Who are the potential buyers?

A: Reports indicate interest from at least four bidders, including Middle Eastern sovereign wealth funds and strategic investors focused on retail or luxury sectors.

Q4: When might the deal close?

A: A transaction could be finalized as early as 2026, based on current talks.

Q5: How does this affect shoppers at Bergdorf Goodman?

A: In the short term, likely little change, as Saks Global would retain control. Long-term, it could bring improvements like better online features or expanded offerings.

Looking Ahead

As negotiations progress, all eyes will be on how this plays out for Saks Global and the luxury sector. While details remain fluid, the move underscores a pragmatic approach to growth in challenging times. If successful, it could pave the way for more such partnerships, blending heritage with forward-thinking finance.

In conclusion, Saks Global’s potential $1 billion stake sale in Bergdorf Goodman is more than a financial transaction; it’s a snapshot of an industry in transition. By balancing debt reduction with strategic investment, the company positions itself for long-term stability, ensuring that icons like Bergdorf continue to thrive in a changing retail landscape.

Leave a Reply