- Home

- /

- Stock Market

- /

- The Fed’s Rate Cuts: Steering…

Introduction

The Federal Reserve’s recent decision to lower interest rates has captured headlines, signaling a shift in its approach to managing the U.S. economy. On September 18, 2025, the Fed cut its benchmark rate by a quarter percentage point, bringing it to a range of 4 percent to 4.25 percent. This marks the first reduction since December of the previous year and comes amid a backdrop of weakening job growth, persistent inflation pressures from tariffs, and intense political scrutiny. As we closely follow economic policy, we find this moment fascinating because it highlights the Fed’s delicate balancing act between supporting employment and keeping prices in check. In this article, we will dive into the details of this move, explore the debates within the Fed, and consider what it means for everyday Americans and the broader economy.

Why the Fed Cut Rates Now

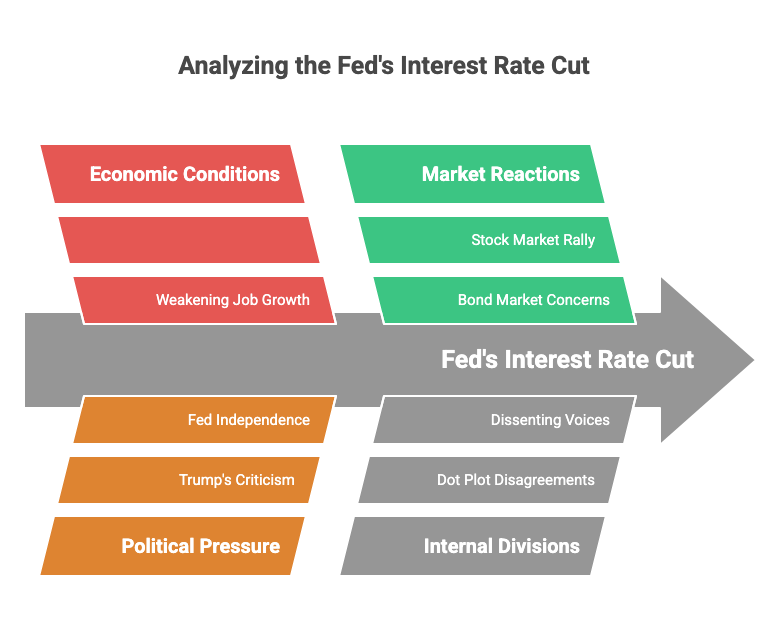

The Fed’s primary tools for influencing the economy are interest rates, which affect everything from borrowing costs to investment decisions. For months, officials had held rates steady to assess the impacts of President Donald Trump’s policies, including widespread tariffs that have driven up prices for imported goods. However, recent data painted a concerning picture of the labor market. Job growth averaged just 29,000 per month over the summer ending in August 2025, a sharp slowdown from earlier in the year. Unemployment ticked up to 4.3 percent, with Black workers facing a rate of 7.5 percent, the highest since late 2021. This disparity has long been seen as an early warning sign of broader economic weakness.

Fed Chair Jerome Powell described the cut as a “risk management” step during his post-meeting press conference. He emphasized that the labor market’s softening posed greater downside risks than before, even as inflation hovered at 2.9 percent in August, above the Fed’s 2 percent target. Powell noted that tariff-related price increases appear more gradual and less severe than initially feared, reducing the odds of a runaway inflation spiral. Economists like Jonathan Pingle from UBS agree, pointing out that the Fed’s tools are better suited to addressing labor market issues than external factors like trade policies.

This pivot prioritizes employment over inflation containment, a reversal from the Fed’s stance earlier in the year. Powell made it clear that the central bank cannot tackle both goals simultaneously without trade-offs. If rates stay too high for too long, it could tip the economy into recession; cut too aggressively, and inflation might rebound.

Divisions Within the Fed: The Dot Plot and Dissent

One of the most revealing aspects of the September meeting was the Fed’s “dot plot,” a chart showing where each of the 19 policymakers expects rates to end up over the coming years. The plot revealed significant splits. Most officials anticipate another half percentage point reduction by year’s end, potentially bringing rates to 3.5 percent to 3.75 percent. However, six policymakers projected no further cuts in 2025, while one outlier called for rates as low as 2.75 percent to 3 percent.

That lone dot likely belongs to Stephen Miran, Trump’s top economic adviser, who was sworn in as a Fed governor just before the meeting. Miran, still tied to the White House through an unpaid leave from his role as chair of the Council of Economic Advisers, dissented from the group’s decision, advocating for a larger half-point cut. This was the only formal dissent in an 11-1 vote, a narrower divide than some expected given prior meetings where governors like Christopher Waller and Michelle Bowman had pushed for earlier reductions.

Former New York Fed President Bill Dudley praised Powell’s ability to forge consensus, noting that the chair remains “firmly in control.” Powell downplayed Miran’s push for considering a third mandate of moderate long-term rates, insisting the Fed focuses on its dual goals of price stability and maximum employment. This internal tension underscores the challenges of policymaking in a politically charged environment.

Trump’s Pressure and the Fight for Independence

No discussion of recent Fed actions would be complete without addressing President Trump’s relentless campaign to influence the central bank. Trump has publicly criticized Powell, attempted to fire him over building renovation costs, and pushed for steeper rate cuts to boost growth. He rushed Miran’s confirmation and tried to oust Governor Lisa Cook over unproven mortgage fraud allegations, marking the first such attempt in the Fed’s 111-year history. A federal appeals court temporarily blocked Cook’s removal, allowing her to participate in the meeting.

Powell has steadfastly defended the Fed’s independence, stating during the press conference that decisions are driven by data, not politics. When asked how the public can gauge if the Fed has been politicized, he suggested watching their actions and speeches. Economists like Narayana Kocherlakota, a former Minneapolis Fed president, worry that aggressive cuts could appear as capitulation to White House pressure, even if economically justified. Despite these efforts, the Fed’s measured quarter-point cut shows it has not fully bent to Trump’s will, though Miran’s presence hints at future battles.

Market Reactions: A Mixed Bag

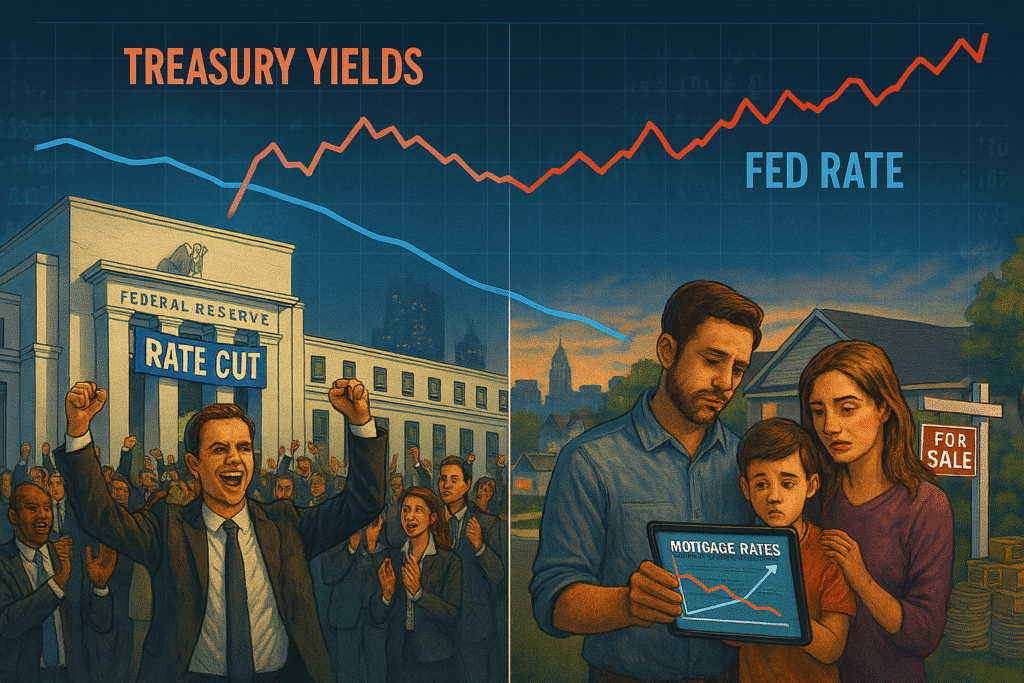

Markets responded unevenly to the announcement. Stocks initially rallied, with the Dow climbing as much as 480 points before closing up 260 points, or 0.57 percent. The S&P 500 and Nasdaq ended slightly lower, dragged down by tech giants like Nvidia and Broadcom. David Kelly from JPMorgan Asset Management called the move reassuring, reinforcing the Fed’s balanced approach.

Bond markets told a different story. Longer-term Treasury yields rose after the cut, with the 10-year yield jumping above 4 percent and the 30-year nearing 4.76 percent. This counterintuitive reaction reflects investor concerns that easing too soon could reignite inflation, especially with updated Fed projections showing slightly higher price growth in 2026. As Peter Boockvar from One Point BFG Wealth Partners explained, bond traders are signaling caution: lower rates amid sticky inflation might not be ideal for long-duration securities.

The U.S. dollar fluctuated, initially dipping before strengthening, while the housing sector felt the pinch. Mortgage rates, which track the 10-year Treasury, rose after hitting a yearly low of 6.35 percent the prior week. Homebuilders like Lennar reported weaker-than-expected results, citing elevated rates as a drag.

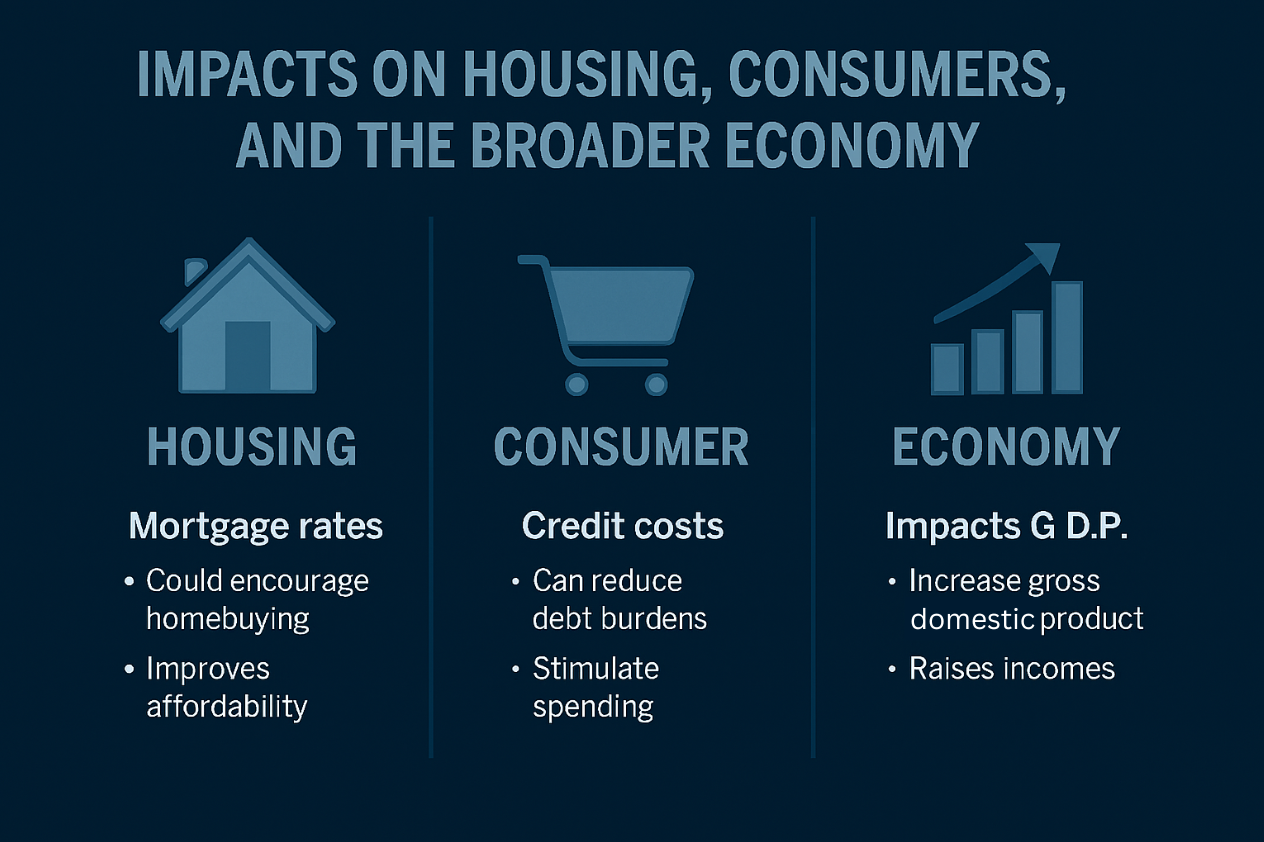

Impacts on Housing, Consumers, and the Broader Economy

For many Americans, the real question is how these cuts affect daily life. In housing, Powell acknowledged that lower rates could ease borrowing for builders and buyers, but a nationwide shortage of homes remains a deeper issue the Fed cannot fix. Experts like Chen Zhao from Redfin predict rates will stay steady in the short term, with volatility ahead. Bill Banfield from Rocket Mortgage suggests adjustable-rate mortgages might become more appealing as they follow Fed moves closely.

Consumers are bearing some tariff costs, with businesses passing on higher prices for certain goods. Recent CPI data shows import prices up 0.3 percent, contributing to inflation. On the jobs front, rising long-term unemployment and fewer job openings signal caution. Moody’s Analytics estimates a 48 percent recession risk in the next year, partly based on falling building permits, which hit a five-year low in August.

Tariffs complicate the picture further. While the Fed expects its inflationary effects to fade within two to three quarters, they have already slowed hiring amid Trump’s immigration policies, which may reduce labor supply.

Recommended Readings

For deeper insights into the Federal Reserve and monetary policy, consider these books:

- “The Lords of Easy Money” by Christopher Leonard which explores the Fed’s role in financial crises and easy money policies.

- “The Federal Reserve and the Financial Crisis” by Ben S. Bernanke offers a former chair’s perspective on decision-making during turbulent times.

- “Fed Up: An Insider’s Take on Why the Federal Reserve is Bad for America” by Danielle DiMartino Booth provides a critical view from within the system.

- “A Term at the Fed: An Insider’s View” by Laurence H. Meyer details the intricacies of Fed operations and policy debates.

FAQ

Q1: What prompted the Fed to cut rates in September 2025?

A: The cut was driven by signs of a weakening labor market, including slow job growth and rising unemployment, particularly among vulnerable groups. Inflation remains above target but is seen as manageable, with tariff effects expected to be temporary.

Q2: How does this affect mortgage rates?

A: Mortgage rates often follow longer-term Treasury yields, which rose after the cut due to inflation concerns. While short-term relief is possible, experts expect volatility, and a nationwide housing shortage continues to drive up prices.

Q3: What role did President Trump play in the decision?

A: Trump has pressured the Fed for steeper cuts through public criticism and appointments like Stephen Miran. However, the Fed insists its moves are data-driven, not political, though internal dissents highlight tensions.

Q4: Could more rate cuts lead to higher inflation?

A: Yes, easing too quickly risks stoking inflation, especially with tariffs in play. The Fed is balancing this against employment risks, but bond market reactions suggest investors are wary.

Q5: Is a recession likely soon?

A: Models like Moody’s put the odds at 48 percent in the next year, based on weak indicators like building permits and job data. The Fed’s cuts aim to mitigate this, but external factors add uncertainty.

Looking Ahead: More Cuts on the Horizon?

The dot plot suggests officials see rates falling to around 3 percent by the end of 2026, but projections can shift with new data. Powell stressed a data-dependent approach, with meetings in October and December offering chances for further adjustments. Risks remain tilted: upside for inflation from trade policies, downside for employment from any slowdown.

As Michael Gapen from Morgan Stanley noted, the Fed must weigh credibility; prolonged high inflation could erode trust. Yet, with growth forecasts revised upward, the economy appears resilient for now.

In wrapping up, the Fed’s rate cuts represent a pragmatic response to evolving challenges, prioritizing job protection while navigating political headwinds and tariff-driven inflation. This moment reminds us that monetary policy is as much art as science, with real stakes for workers, borrowers, and investors. As we monitor upcoming data, the Fed’s independence will be key to maintaining stability. Whether this cut averts deeper troubles or merely delays them remains to be seen, but it underscores the ongoing need for vigilant economic stewardship.

Leave a Reply