- Home

- /

- Venture Capital

- /

- The Great Un-Merger: Kraft Heinz…

Introduction

In the high-stakes world of Big Food, few names carry as much weight as Kraft Heinz. For generations, its products, from the tangy zip of Heinz ketchup to the creamy comfort of Kraft Mac & Cheese, have been staples in kitchens worldwide. But now, in a dramatic corporate U-turn, this packaged food giant is breaking up. The very merger that was meant to create an unstoppable titan is being undone, a stark admission that even the most iconic brands can’t escape the changing tastes of consumers. This is the story of why Kraft Heinz is splitting in two and what it means for the future of your grocery shelf.

Why Split a Giant? The Cracks in the Foundation

The move, announced this week, will see Kraft Heinz divide its iconic portfolio:

- Global Taste Elevation Co. (Temporary Name): This will become the intended growth star, housing powerhouse brands like Heinz ketchup, Philadelphia cream cheese, and Kraft Mac & Cheese. This unit, with about $15.4 billion in sales, is seen as having more potential for international expansion and innovation.

- North American Grocery Co. (Temporary Name): This company will hold the “legacy” brands, the staples of pantries for generations, including Oscar Mayer cold cuts, Lunchables, Kraft Singles, and Maxwell House coffee. With $10.4 billion in sales, it’s expected to be a reliable, if slower-growing, cash generator.

The official reason, as stated by Executive Chair Miguel Patricio, is that “the complexity of our current structure makes it challenging to allocate capital effectively.” In simpler terms, the company became too big and cumbersome to manage. It couldn’t nimbly invest marketing dollars or develop new products for its fastest-growing brands because it was constantly propping up its slower-moving ones.

But the real reasons run much deeper.

A Merger Backed by Giants, Undone by Reality

The original 2015 union between H.J. Heinz and Kraft Foods was a classic playbook move by Warren Buffett’s Berkshire Hathaway and Brazilian private equity firm 3G Capital. Their strategy was ruthless efficiency: consolidate, cut costs, and squeeze profits from beloved brands through a strict system called “zero-based budgeting.”

For a while, it worked on paper. But the strategy had a fatal flaw. While they were focused on cutting costs and laying off thousands of employees, they were starving the very brands that needed investment.

Meanwhile, consumers were changing. The trend toward healthier, less-processed foods accelerated. Shoppers became more price-conscious, often choosing cheaper store-brand alternatives over name-brand products. Why pay $2.98 for Heinz ketchup when Walmart’s Great Value brand costs 98 cents?

The company’s struggles culminated in a catastrophic 2019 moment when it slashed the value of its Oscar Mayer and Kraft brands by $15.4 billion. The message was clear: the brands themselves were worth far less than the company had thought.

Wall Street’s Skeptical Yawn

The market’s reaction to the split announcement was telling: shares fell. They closed down nearly 5% on the day, reflecting investor skepticism.

This skepticism is best voiced by the company’s own largest shareholder, Warren Buffett. In a surprising reveal, Buffett told CNBC he was “disappointed” in the decision and that Berkshire Hathaway opposed it. “It certainly didn’t turn out to be a brilliant idea to put them together,” he conceded, “but I don’t think taking them apart will fix it.”

His frustration highlights the core question: Is a split enough? As analyst Suzy Davidkhanian noted, the move might “unlock value in the near-term,” but unless both new companies radically innovate and fend off private-label competition, the breakup may only provide a temporary financial lift.

Part of a Bigger Trend: The End of the Food Conglomerate?

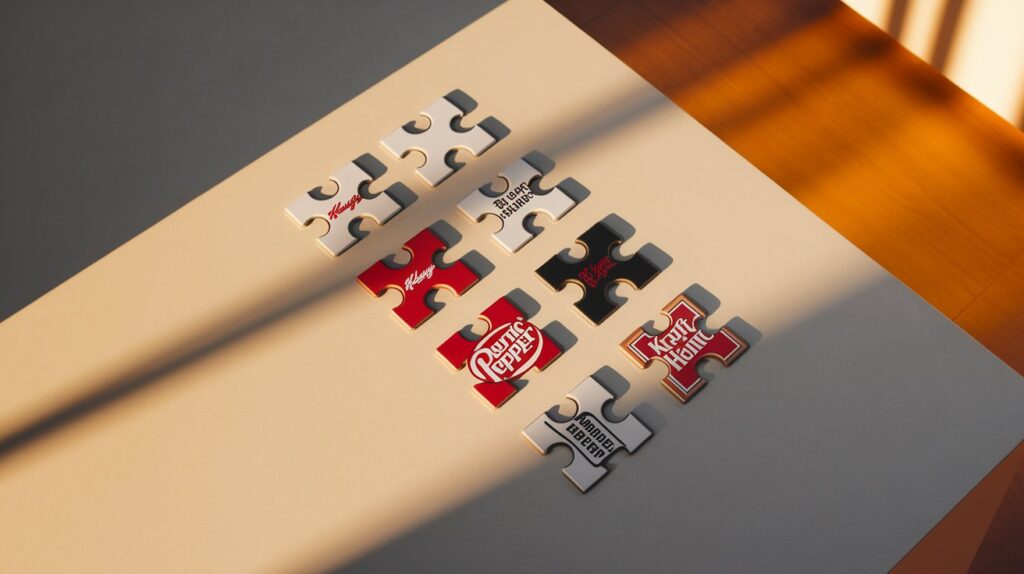

The Kraft Heinz split isn’t happening in a vacuum. It’s the latest in a wave of corporate break-ups in the food and beverage industry. Last week, Keurig Dr Pepper announced a similar plan to split after a major acquisition. In 2023, Kellogg split into two separate companies.

The era of building massive conglomerates is seemingly over. The new strategy is focused. In a hyper-competitive market, companies are learning that it’s better to be a nimble expert than a slow-moving giant.

What Happens Next?

The split, expected to finalize in late 2026, will be a complex and costly process, with fees estimated at around $300 million. Current Kraft Heinz CEO Carlos Abrams-Rivera will lead the North American Grocery unit, while a new CEO will be sought for the Global Taste Elevation company.

The two new companies will have their work cut out for them. One must prove it can truly grow in a health-conscious world. The other must defend its turf against relentless store brands.

Frequently Asked Questions (FAQ)

Q1: Why is Kraft Heinz splitting up?

A: The company never achieved the growth expected after its 2015 merger. The split aims to create two more focused companies that can better compete, innovate, and allocate resources. One will handle high-growth brands like sauces, while the other will manage stable, but slower-growing, grocery staples.

Q2: What will the two new companies be?

A:

- Company One (Global Taste Elevation): Heinz ketchup, Philadelphia cream cheese, Kraft Mac & Cheese, and other sauces/condiments.

- Company Two (North American Grocery): Oscar Mayer, Lunchables, Kraft Singles, Maxwell House, and Velveeta.

Q3: When will the split happen?

A: The tax-free spinoff is expected to be completed in the second half of 2026.

Q4: What was Warren Buffett’s reaction?

A: Buffett, whose Berkshire Hathaway is the largest shareholder, expressed disappointment and stated that he opposed the move. He believes that while the original merger was a mistake, splitting the company apart will not necessarily fix its underlying problems.

Q5: Will this affect the products I buy?

A: In the short term, no. You likely won’t see any immediate changes on store shelves. The long-term goal is that each company will be better able to innovate and improve its respective products.

Q6: How much will the split cost?

A: Kraft Heinz estimates the total cost of the separation will be up to $300 million.

Q7: Is this part of a larger trend?

A: Yes. Other major food and beverage companies like Kellogg (which split into Kellanova and WK Kellogg Co.) and Keurig Dr Pepper have recently announced similar break-ups, moving away from the conglomerate model towards more focused business units.

Conclusion: More Than Just a Corporate Divorce

The breakup of Kraft Heinz is more than a corporate restructuring; it’s a symbol of a fundamental shift in consumer culture. It marks the end of an era defined by consolidation and cost-cutting, and the beginning of a new, uncertain chapter where agility, innovation, and brand relevance are the only currencies that matter. For Kraft Heinz, the divorce is a chance for its beloved brands to rediscover their individual identities and reconnect with the shoppers who grew up with them. Their success is far from guaranteed, but one thing is certain: the landscape of the grocery store will never be the same.

Leave a Reply