Introduction: When Systemic Efficiency Becomes Systemic Brittleness

The Collapse of Reliability: Setting the Scene

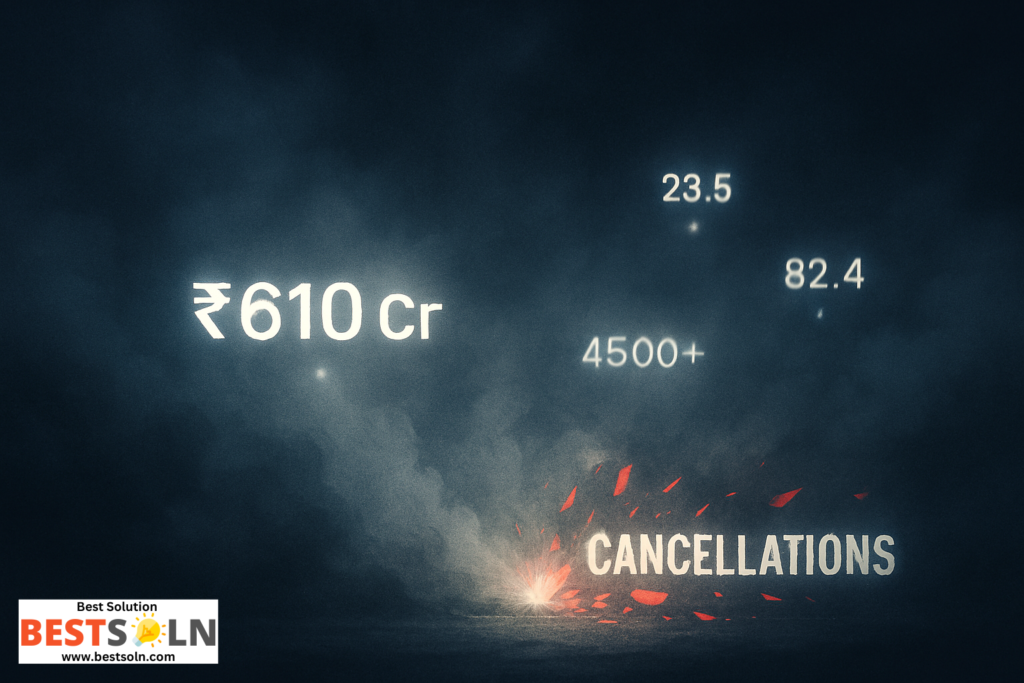

The operational meltdown experienced by IndiGo in December 2025 serves as a profound case study in the risks inherent to ultra-efficient business models operating complex, high-reliability infrastructure. IndiGo, India’s largest airline, which controls between 60% and 65% of the domestic aviation market share, built its entire brand on the promise of operational reliability and guaranteed on-time performance (OTP). Yet, in a stark reversal of fortune, the company saw its system collapse, resulting in the cancellation of over 4,500 flights across its network in just seven days. This chaos coincided with the peak wedding and travel season, severely disrupting tens of thousands of travelers and leading to an unprecedented shock surge in demand for alternative options, including private jet charter bookings. During the worst period of the disruption, IndiGo’s OTP reportedly plummeted to approximately 10%.

Defining the ‘Too Lean’ Strategy Failure (Operational Resilience Failure)

This crisis was not triggered by an unforeseen external event, such as a major technological failure or extreme meteorological anomaly. Instead, it was the predictable consequence of combining an aggressive, decade-long cost minimization strategy, the classic Lean Operations Failures model, with a known, impending regulatory change regarding pilot rest. The regulatory shock of the new Flight Duty Time Limitations (FDTL) exposed the pre-existing, critical deficit in pilot staffing and operational slack.

The event, therefore, represents a failure mode common to complex organizations that prioritize short-term profit maximization by eliminating systemic buffer capacity. This strategic choice ultimately created a brittle system. The underlying issue is that the leadership team structurally designed the organization to minimize internal slack, thereby maximizing profitability, but in doing so, they involuntarily transferred the resulting operational risk (financial, political, and social) onto the passengers, the government, and the frontline staff. This forced transfer of operational risk is the most important lesson in Aviation Crisis Lessons.

This report posits that the IndiGo Crisis delivers three critical strategic lessons for corporate boards, Chief Operating Officers, and institutional investors:

- Operational Buffer is Non-Negotiable: Strategic operational buffer capacity is not a cost center but an essential insurance policy against systemic risk.

- Reputation and Human Capital are the True Costs: The long-term costs of ultra-lean strategies reside in enduring reputational damage and the degradation of human capital, which cannot be easily calculated or refunded.

- Due Diligence Must Shift to Resilience: For “Too Big to Fail” infrastructures, investor due diligence must pivot its scrutiny from efficiency metrics to validated systemic resilience metrics.

The Anatomy of Operational Collapse: Deconstructing the Crisis Root Causes

The magnitude of the December 2025 disruption was fueled by a convergence of regulatory pressure and organizational deficiency, culminating in a systemic breakdown.

The Regulatory Stress Test: Flight Duty Time Limitations (FDTL)

The catalyst for the meltdown was the Directorate General of Civil Aviation’s (DGCA) new Flight Duty Time Limitations (FDTL) norms. These new rules, intended to enhance pilot safety by requiring greater mandated crew rest periods, were fully implemented on November 1, 2025. The regulatory changes instantly increased the number of pilots necessary to staff the existing flight schedule, imposing a non-negotiable stress test on the airline’s crew utilization rates.

The failure to prepare for this shift is particularly notable because the changes were widely known, and the industry had a compliance window stretching back months. The government met with IndiGo on December 1, 2025, to clarify the new FDTL rules. Alarmingly, the airline did not flag any operational issues or impending crises at this meeting, only for the situation to escalate rapidly two days later, on December 3.

Organizational Blindness and Internal Planning Deficits

The root cause of the Operational Resilience Failure was explicitly identified by the Union Civil Aviation Minister, Kinjarapu Ram Mohan Naidu, who told the Rajya Sabha that the crisis stemmed from profound deficits within the airline’s “crew rostering and internal planning system”.

The Minister noted that the rostering issue was a “day-to-day operations thing that Indigo should have maintained” and that the airline was responsible for handling crew and roster planning through its daily operations. This diagnosis highlights that the failure was not solely due to pilot shortage but also the inadequate technological and managerial systems needed to integrate regulatory changes into a dynamic, complex flight schedule. The failure to deploy a system capable of dynamically adjusting the schedule in anticipation of marginal shortages or increased rest requirements shows a strategic decision to underinvest in essential operational technology. The company incurred a strategic debt by opting for years of short-term cost savings (avoiding hiring) and deferring the resulting compliance cost, which materialized catastrophically.

The Warning Signals that Went Unheeded (Lean Operations Failures)

The organizational failure occurred despite numerous prior warnings. A parliamentary standing committee, chaired by Sanjay Jha, had issued stern warnings in August 2025 about mounting systemic risks in Indian aviation. The committee specifically cautioned that the “mismatch between rapid fleet expansion and lagging pilot and air traffic controller (ATC) recruitment” was pushing the system toward a critical inflection point.

Furthermore, the Federation of Indian Pilots (FIP) had explicitly accused IndiGo of relying on a “prolonged, unorthodox lean manpower strategy” and staffing shortages. They urged the DGCA to ensure airlines possessed adequate staff under the new FDTL norms before approving schedules. These warnings confirm that the lack of buffer was a known, calculated, long-term Business Strategy choice rather than an accident.

Quantifying the Immediate Financial and Regulatory Costs

The immediate financial and regulatory consequences of the crisis were severe. The Ministry of Civil Aviation confirmed that IndiGo processed ₹610 crore in refunds to affected passengers following the six-day nationwide disruption.

The government responded with strict oversight, mandating several passenger-centric actions:

- The Ministry imposed immediate fare caps on affected routes to prevent other airlines from exploiting the temporary market scarcity.

- IndiGo was ordered to complete all pending refunds and was prohibited from levying any rescheduling fees for impacted passengers.

- The government issued a show-cause notice to IndiGo CEO Pieter Elbers and COO Isidre Porqueras over the disruptions and regulatory non-compliance.

- The Ministry’s oversight extended to directing the airline to trace and deliver all misplaced or separated baggage within 48 hours, with 3,000 pieces already delivered through this push.

The timeline of the strategic failure is crucial for understanding how predictable negligence escalated into a national crisis.

IndiGo Crisis: Strategic Failure Timeline and Regulatory Exposure

| Date/Timeframe | Event/Action | Significance |

| Early August 2025 | Parliamentary Committee issues stern warning | Unaddressed pre-crisis signal about pilot shortage and systemic risk |

| November 1, 2025 | New FDTL norms fully take effect | Catalyst requiring immediate operational adaptation |

| December 1, 2025 | Govt meets IndiGo; airline reports stability | Organizational planning failure/misrepresentation of readiness |

| December 3, 2025 | Crisis escalates significantly | Point of systemic operational collapse |

| December 2-7, 2025 | Over 4,500 flights cancelled; ₹610 Cr refunded | Scale and cost of Operational Resilience Failure |

| December 7, 2025 | DGCA grants temporary FDTL exemption (till Feb 2026) | Regulatory capitulation; potential corporate strong-arm success |

Strategic Lesson 1: Operational Buffer is the Only True Insurance Against Systemic Risk

The Inverse Cost Curve: Marginal Savings vs. Exponential Failure Cost

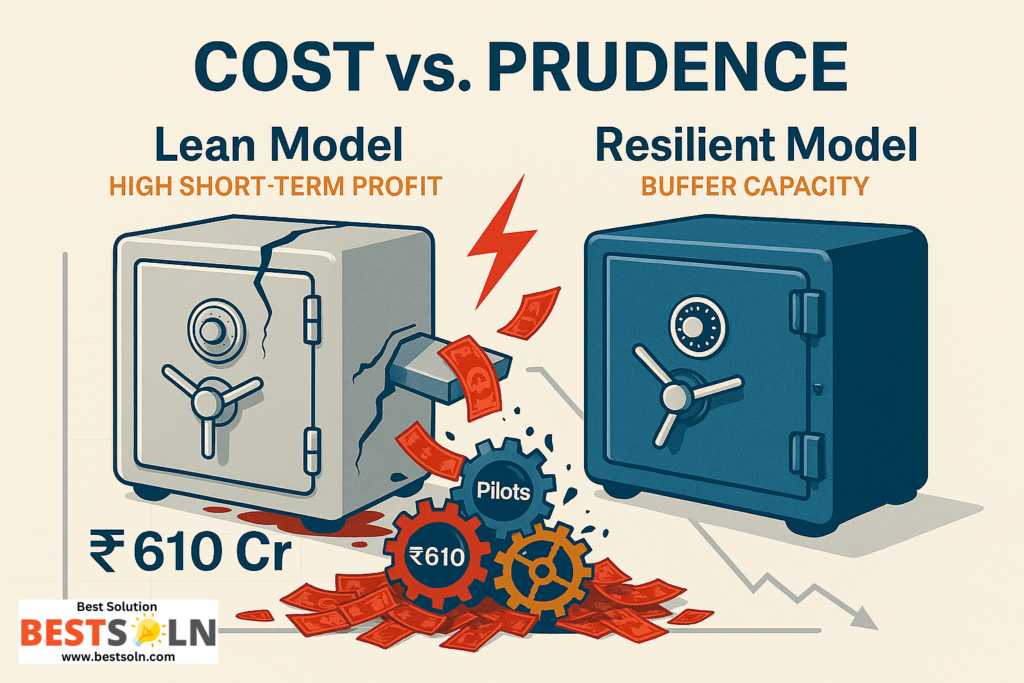

The central lesson emerging from the IndiGo Crisis is the necessity of buffering complex operational systems. The crisis highlights a dangerous miscalculation in corporate strategy: the marginal cost savings achieved by maintaining a zero-slack, minimal pilot roster were immediately and catastrophically offset by the multi-hundred-crore cost of failure. The total expense, including refunds, regulatory exposure, and lost future revenue, dwarfs the projected expense of staffing a sufficient pilot buffer in the preceding years.

Prudent strategic planning recognizes that the cost of acquiring and retaining a 10% to 15% redundancy of pilots is not an expense burden but a strategic, non-negotiable insurance premium against systemic operational failure. The evidence shows that the cost of negligence is orders of magnitude higher than the cost of prudence.

The Resilience Premium (Operational Resilience)

Operational Resilience, especially in aviation, is quantified by the ability of the system to absorb predictable shocks, be they technical, meteorological, or regulatory, without resulting in significant degradation of the published schedule. This resilience is directly dependent on resource slack, particularly in human capital.

The strategic failure in manpower management lies in treating qualified human capital as a variable cost to be minimized, rather than as critical infrastructure to be protected. When the demand for this resource suddenly tightened due to new regulatory mandates, the brittleness of the system became immediately apparent. The operational buffer is essential to cover routine operational friction, including sick leave, mandatory training requirements, and unpredictable weather delays that push crews against FDTL limits.

The following analysis demonstrates the critical strategic tradeoff between minimizing cost and ensuring systemic stability.

Strategic Tradeoffs: Cost of Operational Buffer vs. Cost of Failure

| Factor | Zero-Slack Model (IndiGo Strategy) | Resilience Model (Recommended Buffer) |

| Human Capital Buffer (Pilots) | Minimal mandated staffing (High utilization) | 10% to 15% Crew Redundancy/Slack |

| Annualized Cost | Low variable operating cost | Higher variable operating cost (Insurance premium) |

| Regulatory Adaptation | Failure to adapt, leading to a mass cancellation risk | Proactive compliance, stable scheduling |

| Crisis Financial Impact | ₹610 Crore Refunds (Single Event) + Fines | Near-zero flight disruption costs |

| Reputation Impact | Catastrophic erosion of the reliability brand | Brand stability and trust reinforcement |

This lesson extends beyond aviation; any organization running critical infrastructure (e.g., logistics, energy, complex manufacturing) must acknowledge that minimum compliance staffing equates to maximum organizational brittleness. The choice to run lean for profit is a choice to assume an uninsurable, catastrophic risk on operational stability.

Strategic Lesson 2: The Reputational and Human Cost of Ultra Lean Operations

Brand Implosion and Market Scrutiny

The cost of failure is most enduring in the realm of reputation. IndiGo had spent years building a brand based on reliability; the December crisis achieved what competitors could not: “it seriously damaged the reputation of India’s most powerful aviation brand,” destroying fundamental customer trust. Analysts labeled the reputational damage “severe”.

Although IndiGo maintains a commanding 60% market share, this failure provided competitors with a rare opportunity for market shifting. The reliability concerns were so acute during the crisis that many high-budget travelers migrated to the private jet charter industry, leading to a shock surge in bookings and charter companies operating at maximum capacity. This indicates that the cost of reputational damage is measurable through immediate changes in customer behavior, even among passengers who would typically return due to the carrier’s structural dominance.

The Abandonment of the Frontline: The Human Cost

The ‘Too Lean’ Business Strategy did not stop at the cockpit; it extended to ground operations. This approach culminated in a severe ethical failure in human capital management. The low-paid ground staff, often young women in their twenties earning perhaps ₹25,000 monthly, were left at check-in counters without adequate managerial backup to face hours of sustained anger from thousands of stranded passengers.

These frontline staff became human shields, absorbing rage generated by strategic decisions made years earlier in corporate boardrooms. Their response, “I understand, but I can’t do anything,” underscores their structural powerlessness to solve systemic problems. The psychological impact of facing relentless hostility for failures they did not create is well-documented, leading to stress, exhaustion, and emotional depletion. Furthermore, social media amplified this exposure, as passengers filmed confrontations, potentially associating the staff’s faces with the corporate failure in ways they cannot control.

Unquantified Long-Term Costs: Staff Morale and Attrition

The immediate financial costs (₹610 crore refunds) are dwarfed by the unquantified long-term costs associated with staff morale and attrition. Operational failure quickly cascades into an ethical crisis when the organization fails to protect its vulnerable employees. This predictable consequence jeopardizes future talent retention and further destabilizes Operational Resilience, creating a self-perpetuating risk cycle where burnout drives crew shortages.

The failure of the Human Resources function to raise alarms loud enough about the mounting human capital risk for two years suggests its role was limited purely to short-term cost control, proving ultimately detrimental to the long-term Business Strategy. The cost of retaining talent and staffing a sufficient ground crew buffer is negligible compared to the brand and operational destruction caused by these visible, public meltdowns.

Strategic Lesson 3: The Due Diligence Test for “Too Big to Fail” Infrastructures

The Stock Market Paradox (IndiGo Stock Impact)

One of the most revealing aspects of the crisis was the reaction of the financial markets. Despite the massive operational chaos and reputation damage, the IndiGo stock price only slipped approximately 10.7% in December. Heavy buying quickly emerged on the dip.

Analysts maintained that the operational crisis was a temporary setback. They argued that the stock remains a “structural long-term bet” due to India’s rapidly growing aviation story, the company’s market dominance, its disciplined low-cost model, and a healthy balance sheet. This investor rationale demonstrates a fundamental acceptance that, given its market position, operational failure poses a minimal existential risk.

The Systemic Risk and Regulatory Leverage

IndiGo’s status as a ‘Too Big to Fail’ entity, controlling over 60% of domestic air traffic, acts as a powerful shield. Its sustained failure destabilizes national air transport, especially when combined with the Air India group’s significant share, creating a duopoly that controls 92% of the market. This systemic importance necessitates government intervention and provides the dominant carrier with immense leverage.

The timing and scale of the operational disruption strongly support the hypothesis that IndiGo strategically leveraged its systemic importance to force regulatory concessions. In the midst of the chaos, the DGCA granted a temporary exemption from strict FDTL norms, specifically relaxing night duty rules until February 10, 2026, to help stabilize operations. This outcome demonstrates a worrying dynamic: for dominant carriers, massive Operational Resilience Failure can be converted into successful political leverage against safety regulations designed to protect the system.

VC Due Diligence Redefined (VC Due Diligence)

The crisis necessitates a fundamental shift in how investors assess risk in critical infrastructure sectors. Investment stability in these complex, highly regulated sectors depends less on quarterly profit gains and more on validated systemic stability and risk preparedness.

Investors in critical infrastructure must move beyond traditional efficiency metrics like Cost per Available Seat Kilometer (CASK) and utilization rates, which inherently reward a zero-slack model. Due diligence must now rigorously assess an airline’s capacity for regulatory adaptation, its human capital buffer ratios, and its explicit budget allocation for compliance cost shocks. If investors fund companies that use service disruption as a negotiating tool with regulators, they are implicitly buying into a high-risk governance model. Therefore, sophisticated VC Due Diligence must now audit for the presence of the buffer budget as a core metric of sustainable Business Strategy.

The following table summarizes the market’s paradoxical reaction to the operational failure.

Market and Systemic Risk Profile: The ‘Too Big to Fail’ Dynamics

| Risk Indicator | IndiGo Assessment | Implication for VC Due Diligence |

| Market Share | 60% – 65% Domestic Dominance | Systemic importance necessitates government intervention |

| Stock Reaction | Initial 10.7% dip, followed by ‘Buy the Dip’ consensus | Long-term structural bet overshadows short-term operational risks |

| Regulatory Leverage | Achieved FDTL Exemption (Feb 2026) | Ability to challenge/modify regulatory costs through systemic disruption |

| Investor Risk Focus | Historically focused on CASK/Efficiency | Must now prioritize Operational Resilience and Regulatory Compliance Readiness |

Regulatory Response and the Ethics of Disruption

Tightening Oversight and Passenger Protection

The immediate government response was focused and effective in mitigating the crisis’s impact on passengers. The Ministry of Civil Aviation established a 24/7 control room, mandated the processing of ₹610 crore in refunds, imposed fare caps to curtail opportunistic pricing, and issued a show-cause notice to top IndiGo management. This intense oversight successfully restored airfares to reasonable levels and ensured passenger convenience remained the immediate priority.

The Contradiction of the FDTL Exemption

The most controversial action taken by the DGCA was the granting of a temporary exemption from some FDTL night duty provisions until February 10, 2026. While the regulator stated the exemption was necessary “in public interest” to ensure continuity of essential air services, this decision immediately drew heavy criticism.

Pilot associations argued vehemently that granting selective exemptions undermines the integrity of the safety regulations (FDTL CAR) and sets a dangerous precedent, opening the door for all other operators to demand similar dispensations based on operational or commercial reasons. The DGCA was effectively forced into a governance challenge: choosing between extending the FDTL crisis indefinitely or making a safety compromise to stabilize national air transport. The fact that a single, dominant private entity could manufacture a crisis of sufficient national importance to force regulatory compromise exposes a profound systemic vulnerability in Indian aviation governance.

The Future of Regulatory Compliance (IndiGo Crisis)

As a condition of the exemption, the DGCA demanded a 30-day roadmap from IndiGo for full compliance with FDTL standards and required fortnightly progress reports on crew utilization. While necessary, this ex-post action highlights a regulatory gap. The incident necessitates a long-term governmental review of capacity planning mandates for dominant carriers to ensure that corporate efficiency targets never again compromise national transportation stability and safety standards.

Recommended Readings

- “Normal Accidents: Living with High-Risk Technologies” by Charles Perrow – Provides essential analysis of complex systems and how tightly coupled, centralized organizational structures lead to inevitable and catastrophic failures when risks align.

- “The Checklist Manifesto: How to Get Things Right” by Atul Gawande – Examines the role of operational discipline, managing complexity, and the importance of simple, systemic checks in high-stakes environments like aviation and medicine.

- “Management of Operational Risk” by Ariane Chapelle – Focuses on proactive risk identification, process safety, and the crucial role of managing organizational change in high-reliability operational settings.

- “Safety Management Systems in Aviation” by Alan J Stolzer – Offers an in-depth explanation of safety management systems, risk analysis methodologies, and the systematic mitigation of human errors and mechanical failures in dynamic aviation operations.

Frequently Asked Questions (FAQ)

Q1. What was the root cause of the widespread IndiGo flight cancellations?

A: The primary cause of the widespread cancellations was a critical failure in the airline’s “crew rostering and internal planning system”. This failure was exacerbated by the full implementation of new DGCA Flight Duty Time Limitations (FDTL) rules, which mandated increased rest periods for pilots, instantly revealing a severe, long-term staffing deficit.

Q2. What financial repercussions did IndiGo face immediately?

A: The most immediate and quantifiable financial repercussion was the refund mandated by the government. The Civil Aviation Ministry confirmed that IndiGo processed ₹610 crore in refunds to affected passengers as a direct result of the cancellations and delays.

Q3. Did the DGCA grant IndiGo any exemptions following the crisis?

A: Yes. Despite the operational failure, the DGCA granted IndiGo a temporary relaxation of some FDTL night duty provisions, effectively changing the definition of ‘night’ for the airline from midnight to 6 am to midnight to 5 am. This exemption is valid until February 10, 2026, and was granted to help restore essential air services, a decision that drew criticism from pilot bodies.

Q4. What were the rights of affected passengers during the crisis?

A: Under government oversight, airlines were required to issue full, automatic refunds for cancelled flights without passenger requests. The government also imposed fare caps on affected routes to prevent price gouging and prohibited airlines from levying rescheduling charges on impacted passengers.

Q5. What is the implication of this crisis for investors?

A: The crisis reinforces IndiGo’s ‘Too Big to Fail’ status, which kept its stock stable despite the chaos. However, it signals to investors that sustainable growth must prioritize Operational Resilience and regulatory compliance readiness. VC Due Diligence must now audit for the presence of strategic buffers as a core metric of business strategy, moving past mere efficiency metrics.

Conclusion: A Mandate for Strategic Investment in Resilience

The IndiGo Crisis was not an accident but the consequence of a long-term, calculated Business Strategy error driven by the extreme pursuit of cost efficiency (Lean Operations Failures). The systemic collapse demonstrates definitively that operational slack is an essential component of Operational Resilience and that the cost of failure is astronomical, extending far beyond measurable financial penalties into the realms of reputation, human capital, and regulatory integrity.

The three strategic lessons derived from this analysis, the imperative to budget for buffers, the necessity of valuing and protecting human capital, and the need for VC Due Diligence to prioritize resilience over efficiency, are critical Aviation Crisis Lessons for all high-reliability organizations globally. For complex infrastructures, the definition of ‘Lean’ must evolve from zero-redundancy thinking to intelligent efficiency, where resources are optimally deployed while critical buffers (human and technological) are fully funded and mandated. The only path to guaranteeing stability in a high-growth, highly regulated environment is through strategic, mandated investment in resilience capacity.

Leave a Reply