- Home

- /

- Digitalization

- /

- Understanding Blockchain and Cryptocurrency

Introduction

Understanding blockchain and cryptocurrency involves delving into two revolutionary technologies that have significantly impacted various sectors, from finance to supply chain management. Let’s break down these complex subjects into digestible segments.

Blockchain Technology

What is Blockchain?

Blockchain is a decentralized ledger technology that securely records transactions across multiple computers. This decentralized nature ensures that no single entity has control, making the system highly secure and resistant to tampering.

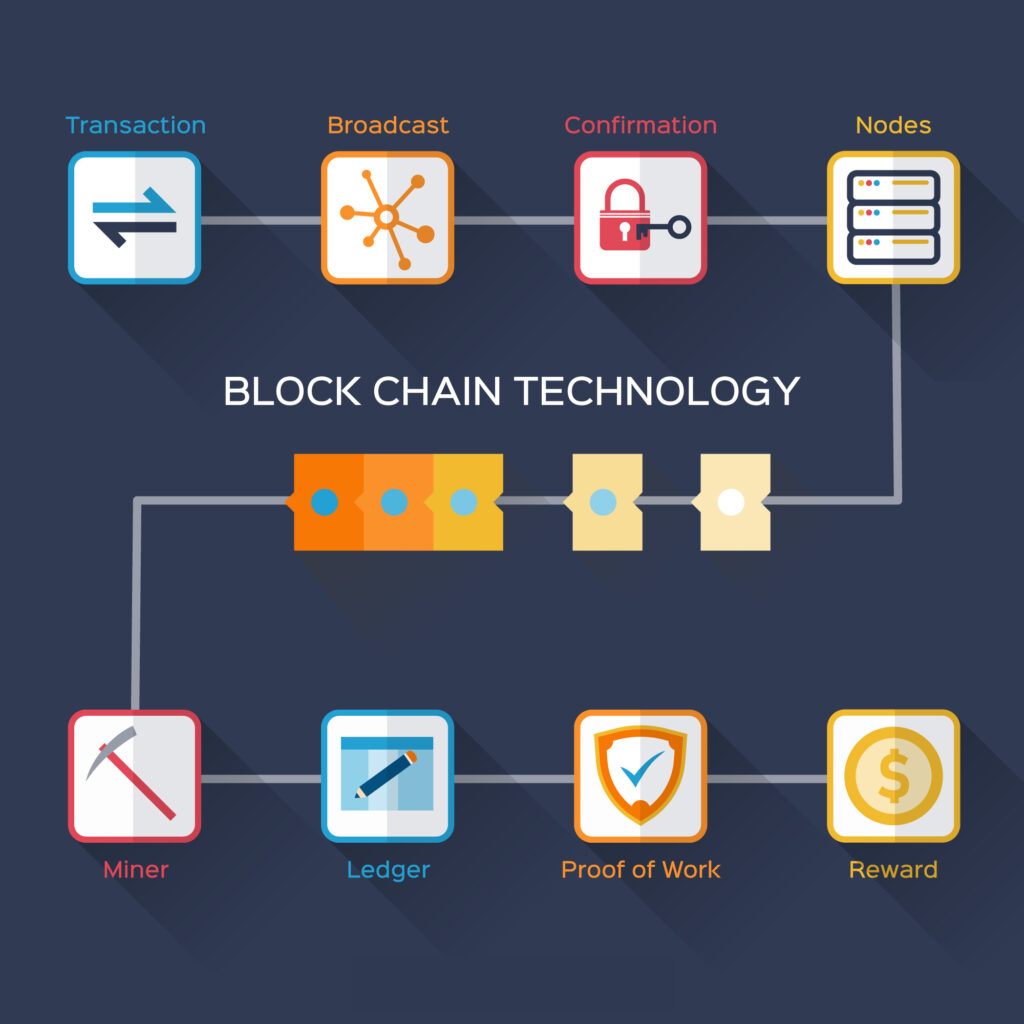

How Does Blockchain Work?

At its core, blockchain is made up of a series of blocks, each with a list of transactions. Each block has a unique identifier called a cryptographic hash, along with the hash of the previous block, creating a chain of blocks. This linkage ensures that any attempt to alter a block would require altering all subsequent blocks, which is practically impossible due to the computational power needed.

Example: Bitcoin Blockchain

Bitcoin, the first and best-known application of blockchain technology, keeps track of all transactions on a blockchain. Every 10 minutes, a new block is added to the Bitcoin blockchain, containing a list of recent transactions.

Key Features of Blockchain

- Decentralization: Unlike traditional databases controlled by a central authority, blockchain is maintained by a network of nodes (computers).

- Immutability: Once data is written to a blockchain, it is nearly impossible to alter.

- Transparency: All transactions are transparent to participants, which increases trust.

- Security: The cryptographic nature of blockchain makes it highly secure against fraud and cyber-attacks.

Types of Blockchains

Blockchains are classified into several types, each serving a unique purpose:

- Public Blockchains: Open to anyone; Bitcoin and Ethereum are prime examples.

- Private Blockchains: Restricted to certain participants; frequently used by businesses.

- Consortium Blockchains: Controlled by a group of organizations; useful for industries like banking.

- Hybrid Blockchains: Combine elements from both public and private blockchains.

Components of Blockchain

Network

A blockchain network is a distributed system where nodes (computers) work together to validate and record transactions. The decentralized nature of the network ensures that no single entity has control, enhancing security and transparency.

Example: Bitcoin Network

The Bitcoin network consists of thousands of nodes worldwide. Each node participates in the validation of transactions and the maintenance of the blockchain, ensuring a high level of decentralization and security.

Nodes

Nodes are individual devices within the blockchain network that store, validate, and broadcast transaction data. There are different types of nodes, each serving a specific function:

- Full Nodes: Validate all transactions and blocks, as well as store the entire blockchain.

- Light Nodes: Only store a subset of the blockchain, relying on full nodes for transaction verification. They are more lightweight and suitable for devices with limited storage.

- Mining Nodes: Also known as miners, these nodes perform complex computational tasks to add new blocks to the blockchain, receiving rewards in return.

Example: Ethereum Nodes

Ethereum nodes can be full nodes that store the entire blockchain or light nodes that only store necessary transaction data. This flexibility allows more participants to join the network with varying resource capacities.

Coins

Coins are digital assets native to a blockchain. They serve various purposes, such as acting as a medium of exchange, a store of value, or a unit of account.

Example: Bitcoin (BTC) and Ether (ETH)

- Bitcoin (BTC): The first and most well-known cryptocurrency, used primarily as a digital currency and store of value.

- Ether (ETH): The native coin of the Ethereum blockchain, used to pay for transaction fees and computational services on the network.

Tokens

Tokens are digital assets created on existing blockchains using smart contracts. Unlike coins, they do not have their own blockchain but instead operate on platforms like Ethereum, Binance Smart Chain, or others.

Example: ERC-20 Tokens

On the Ethereum blockchain, ERC-20 tokens follow a specific standard, making them interoperable with various applications and wallets. USDT (Tether) and LINK (Chainlink) are among the most popular ERC-20 tokens.

Smart Contracts

Smart contracts are self-executing contracts that have their terms written directly into code. When certain conditions are met, they automatically enforce and execute agreements, removing the need for intermediaries.

Example: Decentralized Finance (DeFi) Protocols

DeFi platforms like Uniswap and Aave utilize smart contracts to enable decentralized trading, lending, and borrowing without relying on traditional financial institutions.

Consensus Mechanisms

Consensus mechanisms are protocols that ensure all nodes in the network agree on the validity of transactions and the state of the blockchain. Common consensus mechanisms include:

- Proof of Work (PoW): Miners compete to solve complex mathematical puzzles to validate transactions and add new blocks. Used by Bitcoin.

- Proof of Stake (PoS): Validators are chosen based on how many coins they own and are willing to “stake” as collateral. Used by Ethereum 2.0.

Initial Coin Offering (ICO)

An ICO is a fundraising method used by blockchain projects to raise capital by issuing new tokens. Investors purchase these tokens in exchange for established cryptocurrencies like Bitcoin or Ether.

Example: Ethereum ICO

In 2014, Ethereum conducted an ICO, raising over $18 million to fund the development of its blockchain platform. Participants received Ether tokens in return, which have since become highly valuable.

Blockchain Explorers

Blockchain explorers are online tools that allow users to search and view blockchain data, such as transaction history, block information, and wallet addresses.

Example: Etherscan

Etherscan is a popular blockchain explorer for the Ethereum network, providing detailed information about transactions, smart contracts, and token activities.

Wallets

Wallets are digital tools used to store, manage, and transact cryptocurrencies. They come in various forms:

- Hot Wallets: Online wallets are accessible via the Internet; they are convenient but less secure.

- Cold Wallets: These are offline storage and are highly secure against hacks.

- Hardware Wallets: Physical devices for storing private keys offline.

- Paper Wallets: Physical copies of public and private keys.

Example: Ledger Nano S Plus

The Ledger Nano S Plus is a widely used hardware wallet that provides secure storage for multiple cryptocurrencies.

Decentralized Applications (DApps)

DApps are applications that run on a blockchain network, utilizing smart contracts to function without central control. They offer various services, from finance to gaming.

Example: CryptoKitties

CryptoKitties is a popular DApp on the Ethereum network, allowing users to collect, breed, and trade virtual cats using smart contracts.

Oracles

Oracles are services that provide external data to smart contracts, enabling them to interact with real-world events and information.

Example: Chainlink

Chainlink is a decentralized Oracle network that supplies reliable data feeds to smart contracts, enhancing their functionality and scope.

Blockchain Interoperability

Interoperability refers to the ability of different blockchain networks to communicate and interact with each other, facilitating the transfer of assets and information across various platforms.

Example: Polkadot

Polkadot is a blockchain platform that enables interoperability among various blockchains, allowing them to share information and resources seamlessly.

Blockchain vs. Traditional Databases

The main difference between a traditional database and a blockchain is how the data is structured. A blockchain organizes information into groups known as blocks, which contain sets of information. Blocks have specific storage capacities and, when filled, are chained onto the previously filled block, forming the blockchain.

Traditional databases structure data into tables, whereas a blockchain, as its name implies, structures data into chunks (blocks) that are chained together. This makes it fundamentally different in design from a traditional database.

Cryptocurrency

What is Cryptocurrency?

Cryptocurrency is a digital or virtual currency that employs cryptography for security. Unlike traditional government-issued currencies, cryptocurrencies run on decentralized networks using blockchain technology.

How Do Cryptocurrencies Work?

Cryptocurrencies use cryptographic techniques to protect transactions and regulate the creation of new units. Transactions are stored on a blockchain, which ensures transparency and immutability.

Example: Bitcoin

Bitcoin, created in 2009 by an anonymous entity known as Satoshi Nakamoto, is the first and most popular cryptocurrency. It operates on a decentralized network, meaning transactions occur directly between users without an intermediary.

Popular Cryptocurrencies

While Bitcoin is the most well-known, there are thousands of cryptocurrencies with various features and purposes:

- Ethereum (ETH): It is well-known for its smart contract functionality, which enables developers to build decentralized applications (DApps).

- Ripple (XRP): Designed to facilitate fast and low-cost international payments.

- Litecoin (LTC): Often referred to as the silver to Bitcoin’s gold, it allows for faster transactions.

- Cardano (ADA): Focuses on security and scalability through a research-driven approach.

How to Acquire Cryptocurrencies

There are several ways to obtain cryptocurrencies:

- Mining: The process of verifying and adding transactions to the blockchain. Miners are rewarded with new coins.

- Purchasing: Buying cryptocurrencies through exchanges like Coinbase, Binance, or Kraken.

- Earning: Accepting cryptocurrencies as payment for goods or services.

Cryptocurrency Wallets

To store and manage cryptocurrencies, you’ll need a digital wallet. Wallets come in various forms:

- Hot Wallets: Online wallets accessible via the internet; convenient but vulnerable to hacks.

- Cold Wallets: Offline wallets, such as hardware wallets, provide enhanced security.

- Paper Wallets: Physical copies of your public and private keys.

Benefits and Risks of Cryptocurrencies

Benefits

- Decentralization: Reduces the possibility of a single point of failure.

- Lower Transaction Fees: Especially for international payments.

- Accessibility: Provides financial services to the unbanked population.

- Privacy: Allows for anonymous transactions.

Risks

- Volatility: Cryptocurrencies can experience significant price swings.

- Regulatory Uncertainty: Governments are still deciding how to regulate cryptocurrencies.

- Security Risks: Exchanges and wallets can be targets for hackers.

- Scams and Fraud: The unregulated nature can attract malicious actors.

Applications and Future of Blockchain and Cryptocurrency

The potential applications of blockchain and cryptocurrency extend beyond finance. Industries such as healthcare, supply chain management, and real estate are exploring blockchain for its transparency and security benefits.

Blockchain in Supply Chain Management

Companies can use blockchain to track products from manufacturing to delivery, ensuring authenticity and reducing fraud. For instance, Walmart uses blockchain to track food products, enhancing food safety by providing real-time data on product origins.

Blockchain in Healthcare

Blockchain can securely store patient records, ensuring privacy and enabling easy access by authorized parties. MIT’s MedRec project is an example, of using blockchain to create an immutable record of patient data.

The Rise of Decentralized Finance (DeFi)

DeFi platforms use blockchain technology to recreate traditional financial systems, such as lending and borrowing, without intermediaries. Platforms like Aave and Compound are leading this movement, offering users the ability to earn interest on their crypto holdings or take out loans against them.

Conclusion

Blockchain and cryptocurrency represent a paradigm shift in how we perceive and use money and data. While they pose challenges and risks, the potential benefits are enormous. As technology evolves, we can expect even more innovative applications and increased integration into our daily lives.

Understanding these basics is just the beginning. The world of blockchain and cryptocurrency is vast and continuously evolving, promising to reshape industries and redefine trust in the digital age.

Enjoyed this article? Curious about the evolution of the World Wide Web from Web 1.0 to Web 3.0 and beyond? Learn more here.

Leave a Reply