- Home

- /

- Stock Market

- /

- Urban Company IPO: From Startup…

Introduction

The Indian startup scene has seen its share of highs and lows, but few stories capture the imagination quite like Urban Company’s journey to the public markets. On September 17, 2025, the home services platform made a splash with its IPO, drawing massive investor interest and delivering a debut that turned heads across Dalal Street. As someone who’s followed the evolution of India’s digital economy, we find this moment particularly telling. It signals not just confidence in a single company, but in the broader shift toward organized, tech-driven services in everyday life. Let’s dive into what made the Urban Company IPO such a standout event, from its subscription frenzy to the post-listing buzz, and what it might mean for investors eyeing the long game.

The Build-Up: A Record-Breaking Subscription

Urban Company’s IPO opened for subscription on September 10, 2025, and closed just two days later on September 12, but those three days were enough to etch it into the record books. Priced in a band of ₹98 to ₹103 per share, the ₹1,900 crore issue saw bids pour in at an astonishing 103.63 times overall, making it the most subscribed IPO of 2025. Qualified institutional buyers led the charge with 140.20 times subscription, followed by non-institutional investors at 74.04 times and retail investors at 39.25 times. Even the employee portion was oversubscribed 36.79 times.

This enthusiasm wasn’t out of nowhere. The company raised ₹854 crore from anchor investors beforehand, including heavyweights like Goldman Sachs, the Monetary Authority of Singapore, SBI Mutual Fund, HDFC Mutual Fund, Fidelity, Nomura, ICICI Prudential Life, SBI Life, Citigroup, and others. Such backing from global and domestic funds set a strong tone, signaling trust in Urban Company’s model. The issue itself was a mix: ₹472 crore in fresh capital for growth initiatives like technology upgrades, marketing, and office leases, and ₹1,428 crore as an offer for sale, allowing early backers like Accel, Elevation Capital, Bessemer, and others to cash in partial exits.

What fueled this hype? For one, Urban Company’s position as a leader in a fragmented market. Founded in 2014 as UrbanClap by Abhiraj Singh Bhal, Varun Khaitan, and Raghav Chandra, it rebranded to Urban Company and built a platform that connects users with professionals for home and beauty services. Think cleaning, pest control, plumbing, electrical work, appliance repairs, painting, skincare, hair grooming, and massages, all bookable via app or website. By FY2025, it served about 4 million households in India alone, operating in 51 cities there, plus the UAE, Singapore, and Saudi Arabia.

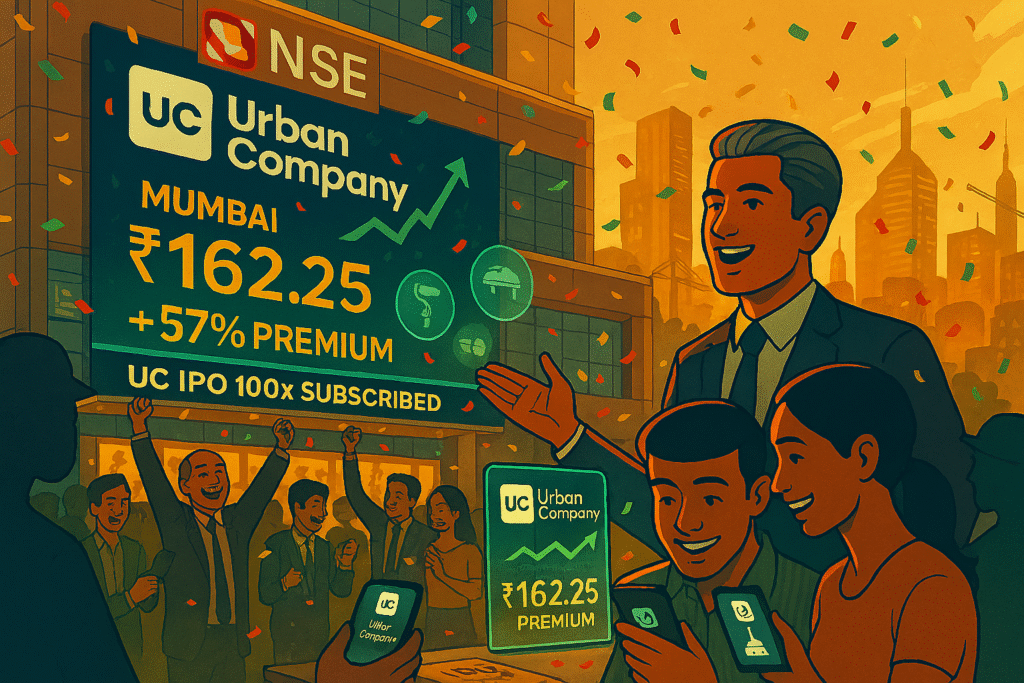

The Listing Day Drama: A Premium Debut

Come listing day on September 17, 2025, the excitement translated into action. Shares opened at ₹162.25 on the NSE, a 57.52% premium over the ₹103 issue price, and ₹161 on the BSE, up 56.31%. The stock climbed further, hitting an intraday high of ₹179, before closing at ₹169 on the NSE (a 64.08% gain from the IPO price) and ₹167.05 on the BSE (62.18% premium). This pushed the company’s market cap past ₹25,000 crore early in the day, reflecting a valuation of around ₹14,800 crore at the upper price band, slightly below its 2021 private round of ₹16,000 crore.

The grey market premium (GMP) had hinted at this strength, hovering around ₹51 to ₹52 in the lead-up, suggesting a 50% pop. And it delivered. As of September 19, 2025, shares were trading around ₹182, up about 7% from the previous close of ₹170.10, marking a nearly 77% rally from the IPO price in just three days. This performance underscores investor faith in the company’s network effects: more users attract better professionals, and vice versa, creating a moat in a sector ripe for digital disruption.

Inside Urban Company: Strengths and Strategies

At its core, Urban Company is a full-stack marketplace that leverages technology for seamless service delivery. Its competitive edges include an established brand, in-house training for professionals, access to tools and consumables, and a robust platform for fulfillment, customer growth, and partner empowerment. In FY2025, revenue hit ₹1,144 crore, up 38% year-over-year, with a profit of ₹240 crore, a stark turnaround from a ₹93 crore loss in FY2024. About 82% of net transaction value came from repeat users, rising to 85% in early FY2026, showing sticky customer loyalty.

Innovation plays a big role, too. The company has launched categories like InstaHelp for quick domestic assistance and products under its ‘Native’ brand, such as water purifiers and electronic door locks. CEO Abhiraj Singh Bhal emphasized that post listing, the focus remains on long-term profitability, with investments in AI for quality control and training centers. Plans include expanding to over 200 cities in India by FY2030, deepening penetration in existing markets, and scaling internationally.

Experts like Ashutosh Sharma from Prosus hailed it as a milestone for India’s digital economy, while Gaurav Garg from Lemonn Markets Desk saw it as a play on sector formalization. Prashanth Tapse of Mehta Equities noted its first-mover advantage in a fragmented space, recommending holds for long-term investors.

Risks and Challenges Ahead

No story is without hurdles. Urban Company faces competition from offline players and niche apps, plus the risk of users bypassing the platform for direct deals, which could compromise safety and quality. International expansion brings currency and regulatory risks. The company has a history of losses and negative cash flows, though it’s now at break-even. Heavy investments in quick services amid rising competition might dent near-term profits, with full profitability guided for FY2028.

Still, its governance stands out: The three founders each hold equal 6.7% stakes, totaling 20.1%, fostering a balanced, promoter-led setup. Strong investor engagement, including lengthy meetings with funds like SBI MF, built transparency and confidence.

Recommended Readings

For those interested in startups, investing, and the Indian economy, here are some insightful books:

- “The Intelligent Investor” by Benjamin Graham: A classic on value investing that helps understand market dynamics like those seen in IPOs.

- “Shoe Dog” by Phil Knight: A memoir on building Nike, offering lessons on scaling a business from scratch, much like Urban Company’s journey.

- “The Ride of a Lifetime” by Robert Iger: Insights into leading a company through growth and innovation, relevant to tech-enabled services.

FAQ

Q1: What is Urban Company?

A: Urban Company is a technology platform that connects customers with professionals for home and beauty services, operating in India and select international markets.

Q2: How did the Urban Company IPO perform on listing day?

A: It listed at a 57-58% premium over the ₹103 issue price, closing around ₹169 on the NSE with strong gains.

Q3: Should I buy Urban Company shares now?

A: Analysts generally recommend holding for the long term if allotted, or waiting for dips if not. Consider your risk tolerance and consult a financial advisor.

Q4: What are the key risks for Urban Company?

A: Competition, potential profitability pressures from expansions, and regulatory challenges in international markets.

Q5: How does Urban Company make money?

A: Through commissions (20-30% on services), subscriptions for professionals, product sales, advertising, and training fees.

What This Means for the Market

Urban Company’s success could reignite interest in startup IPOs, especially in consumer tech. It joins a wave where at least 12 IPOs in 2025 were subscribed over 100 times, but its gig economy focus on home services, a $21 billion addressable market in India’s top 200 cities, sets it apart. As urban households demand convenience and quality, platforms like this are poised to thrive.

In conclusion, the Urban Company IPO wasn’t just a financial event; it was a validation of a decade-long build in organizing chaos. For investors, it offers a window into India’s growing service economy. While short-term gains are tempting, the real value lies in its execution over the coming years. If the company delivers on its promises, this could be one of those stocks that reward patience.

Leave a Reply