- Home

- /

- Digitalization

- /

- Understanding Open Banking, Neo Banking,…

Introduction

In the dynamic landscape of finance, terms like Open Banking, Neo Banking, and API Banking have become increasingly prevalent. Each concept represents a distinct facet of the evolving financial services sector, catering to diverse needs and preferences. Let’s delve into these concepts to understand their differences and significance in the modern banking ecosystem.

Open Banking

Open Banking is a framework that allows third-party financial service providers to access consumer financial information securely. It revolves around the principle of data sharing, empowering customers to grant permission for their financial data to be shared between different financial institutions. This sharing is facilitated through APIs (Application Programming Interfaces), which act as bridges between different systems, enabling seamless data transfer.

Key Features of Open Banking

Data Sharing

Customers can share their financial data securely with authorized third parties.

Enhanced Services

Enables the development of innovative financial products and services.

Customer Control

Customers have control over which data they share and with whom.

Competition and Innovation

Fosters competition among financial institutions, leading to better services and offerings.

Security Measures

Strong security protocols are implemented to protect customer data.

Example of Open Banking

USE CASE: A customer using a budgeting app can securely connect their bank account via Open Banking APIs to track expenses and manage finances more efficiently.

ICICI Bank

ICICI Bank, one of India’s leading private banks, offers Open Banking services through its ‘ICICI Bank APIs’ platform. It provides APIs for account information, payments, fund transfers, and other financial functionalities, enabling developers and businesses to integrate banking services into their applications.

HDFC Bank

HDFC Bank has embraced Open Banking initiatives by offering APIs for various services, including account aggregation, transaction history, loan eligibility checks, and more. Developers can leverage HDFC Bank’s APIs to create innovative financial solutions.

Razorpay (Fintech)

Razorpay, a fintech company based in India, provides Open Banking solutions through its ‘RazorpayX’ platform. It offers APIs for payment processing, account reconciliation, automated payouts, and financial insights, catering to businesses and developers.

HSBC (UK)

HSBC offers Open Banking services through its Connected Money app, allowing customers to view accounts from multiple banks in one place, categorize spending, and set savings goals.

BBVA (Spain)

BBVA has implemented Open Banking initiatives, providing APIs for developers to create innovative financial solutions. They also offer a ‘BBVA API Market’ for developers and businesses to access banking functionalities.

Plaid (USA)

While not a traditional bank, Plaid is a fintech company that specializes in Open Banking solutions. It provides APIs that enable secure data exchange between financial institutions and third-party apps, powering services like account verification and financial data aggregation.

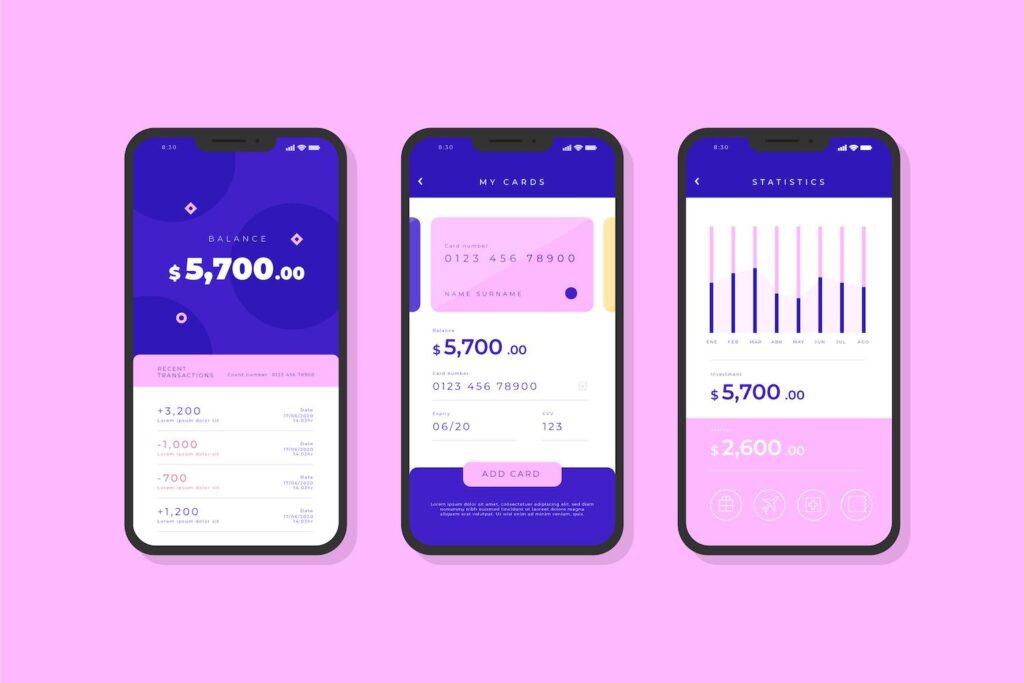

Neo Banking

Neo Banking refers to digital banks that operate solely online, without traditional physical branches. These banks often leverage advanced technology and user-centric approaches to offer a range of banking services, from savings accounts to loans, entirely through digital platforms. Neo banks typically aim to provide a seamless and user-friendly banking experience, targeting tech-savvy customers who prefer digital interactions.

Key Features of Neo Banking

Digital-First Approach

No physical branches; all services are accessible through mobile apps or web platforms.

Cost-Efficiency

Lower operating costs compared to traditional banks, leading to potentially better rates and fees.

Innovative Features

Integrate innovative features like real-time transaction notifications, automated savings, and personalized financial insights.

Accessibility

Convenient access to banking services anytime, anywhere.

Customized Solutions

Tailored offerings based on customer data and preferences.

Example of Neo Banking

USE CASE: A startup entrepreneur opting for a Neo Bank can manage business finances, make payments, and access funding solutions entirely through a user-friendly mobile app.

Fi Money

FI Money is instrumental in enhancing Neo Banking’s reach by leveraging digital solutions to provide essential financial services to underserved populations. Neo banks, with their digital-first approach, can use technologies like mobile banking and digital wallets to offer savings accounts, microloans, and payment solutions to low-income individuals and small businesses. This integration promotes financial inclusion and empowers marginalized communities, contributing to a more inclusive financial ecosystem.

Kotak 811

Kotak Mahindra Bank’s ‘811’ digital banking platform is a notable example of Neo Banking in India. It offers digital account opening, mobile banking services, savings accounts, investment options, and seamless fund transfers, all accessible through the Kotak 811 mobile app.

Niyo Solutions

Niyo Solutions is a Neo Banking platform that provides digital banking solutions for salaried individuals and businesses. Their offerings include salary accounts, expense management tools, corporate cards, and investment options, delivered through their Niyo mobile app.

Open (Fintech)

Open is a fintech company in India that offers Neo Banking solutions for businesses and startups. Their platform includes features like digital invoicing, expense management, automated bookkeeping, and integration with banking services, providing a comprehensive digital banking experience.

Revolut

Revolut is a prominent Neo Bank based in the UK, offering a range of digital banking services such as multi-currency accounts, cryptocurrency trading, budgeting tools, and global money transfers through its mobile app.

N26

N26, headquartered in Germany, is another notable Neo Bank known for its user-friendly mobile banking app. It provides features like fee-free international transactions, budgeting insights, and customizable account options.

Chime (USA)

Chime is a Neo Bank focused on providing accessible and transparent banking services to its customers. It offers features like early direct deposit, no hidden fees, and automated savings tools through its mobile app.

API Banking

API Banking revolves around the use of Application Programming Interfaces (APIs) to enable seamless integration between different financial systems and services. It allows banks and fintech companies to collaborate effectively, sharing data and functionalities to deliver enhanced services to customers. API Banking facilitates the development of open platforms where various financial products and services can be aggregated and accessed through a single interface.

Key Features of API Banking

Interoperability

Enables different systems to communicate and share data securely.

Efficiency

Streamlines processes such as payments, account aggregation, and identity verification.

Scalability

Supports the development of scalable financial solutions and ecosystems.

Innovation

Encourages the creation of new services and partnerships within the financial industry.

Enhanced Customer Experience

Offers seamless and integrated banking experiences to customers.

Example of API Banking

USE CASE: An e-commerce platform integrating API Banking can offer customers instant loan approvals during checkout, based on real-time financial data and creditworthiness assessments.

Axis Bank

Axis Bank offers API Banking services through its ‘Axis Bank APIs’ platform, allowing developers and businesses to access banking functionalities programmatically. Their APIs cover areas such as account information, payments, loans, card services, and more, facilitating seamless integration with banking services.

YAP (Fintech)

YAP is a fintech company in India specializing in API Banking solutions. They provide a range of APIs for payments, card issuance, KYC verification, digital wallets, and loyalty programs, enabling businesses to build customized financial products and services.

Stripe

Stripe is a leading API-based payment processing platform that enables businesses to accept online payments seamlessly. It provides a suite of APIs for payment processing, subscription management, and fraud prevention, catering to businesses of all sizes.

Plaid (USA)

As mentioned earlier, Plaid also operates in the API Banking space, offering APIs for financial data exchange and integration. It facilitates connections between banks, fintech apps, and other financial institutions to enable various banking functionalities.

Open Bank Project (UK)

The Open Bank Project is an open-source API platform for banks, fintech companies, and developers. It provides APIs for account information, transactions, payments, and more, promoting collaboration and innovation within the financial industry.

These examples showcase how banks, fintech companies, and API providers are leveraging technology to offer innovative financial products and services, catering to the evolving needs of customers in the digital era.

Open Banking Vs. Neo Banking Vs. API Banking

Here’s a table summarizing the key differences between Open Banking, Neo Banking, and API Banking:

| Aspect | Open Banking | Neo Banking | API Banking |

| Definition | Framework allowing data sharing via APIs | Digital banks operating solely online | Use of APIs for seamless integration in banking |

| Primary Focus | Data sharing between financial institutions | Digital-first banking experiences | Seamless integration and collaboration |

| Access to Data | Third-party access with customer consent | Digital banking services for customers | Integration of banking services via APIs |

| Customer Control | Customers control data-sharing permissions | User-friendly digital banking interfaces | Seamless banking experiences for end-users |

| Innovation | Customers control data-sharing permissions | Introduces innovative features and services | Customers control data-sharing permissions |

| Examples | HSBC (Connected Money), BBVA API Market | Revolut, N26, Chime | Facilitates the creation of new financial solutions |

This table provides a concise comparison of the key aspects of Open Banking, Neo Banking, and API Banking, highlighting their unique features and focuses in the banking and financial services sector.

Frequently Asked Questions (FAQs) on Open Banking, Neo Banking, and API Banking

What are the benefits of Open Banking for customers?

Open Banking offers several benefits for customers, including enhanced control over their financial data, access to innovative financial products and services, improved personalized experiences, and increased competition leading to better offerings and lower costs.

Can customers trust Open Banking with their sensitive financial information?

Open Banking platforms implement strong security measures, including encryption, secure APIs, and customer consent mechanisms, to protect sensitive financial information. Customers can trust Open Banking as long as they choose reputable and authorized service providers.

What is Neo Banking, and how does it differ from traditional banking?

Neo Banking refers to digital banks that operate entirely online without physical branches. They offer a range of banking services through user-friendly mobile apps or web platforms, focusing on convenience, accessibility, and innovative features not typically found in traditional banks.

What are the advantages of using Neo Banking services?

Neo Banking offers advantages such as 24/7 access to banking services, lower fees, innovative features like real-time notifications and automated savings, seamless digital experiences, and tailored solutions for different customer segments.

How does API Banking enable seamless integration in the banking industry?

API Banking uses Application Programming Interfaces (APIs) to connect different banking systems, fintech apps, and third-party services, allowing for seamless data exchange and integration. This enables banks and fintech companies to offer integrated and customized financial solutions to customers.

What are some examples of banks and fintech companies offering API Banking solutions?

Examples include Stripe, Plaid, Axis Bank APIs, and other platforms that provide APIs for payments, account information, loan processing, and more. These APIs enable businesses to build innovative financial products and services.

How can businesses benefit from API Banking?

Businesses can benefit from API Banking by streamlining processes, reducing costs, improving customer experiences, accessing new revenue streams through partnerships, and staying competitive in the rapidly evolving financial services landscape.

Is API Banking secure, and how do providers ensure data protection?

API Banking providers implement robust security measures, such as encryption, authentication protocols, access controls, and regular security audits, to ensure data protection and prevent unauthorized access or breaches.

Conclusion

In summary, Open Banking focuses on secure data sharing, Neo Banking emphasizes digital-first banking experiences, and API Banking enables seamless integration and collaboration within the financial ecosystem. These concepts collectively contribute to the transformation of banking services, fostering innovation, competition, and improved customer experiences in the digital age. Embracing these concepts strategically can position financial institutions and fintech companies for sustained growth and relevance in the ever-evolving financial landscape.

Leave a Reply