- Home

- /

- Entrepreneurship

- /

- Understanding Startup Laws

Introduction

Startups are the lifeblood of innovation and progress, infusing the business world with fresh ideas and boundless energy. However, the legal maze surrounding startups can be overwhelming for even the most passionate founders. This guide aims to demystify startup laws in simple terms, covering key legal aspects that every startup should be aware of.

Legal Structure

Selecting the appropriate legal structure is critical for your startup. Let’s break down the common options:

Sole Proprietorship

The simplest form of business is where you are the sole owner. You call the shots, but remember, you’re also personally liable for all debts and obligations. Imagine starting a freelance graphic design business from your home. It’s straightforward and requires minimal paperwork, but if a client sues you, your assets are at risk.

Partnership

A business run by two or more people. There are different types, such as general partnerships, where partners share profits and liabilities equally, and limited partnerships, where some partners have limited liability. Think of two friends opening a café. They share responsibilities, profits, and debts. But if one partner makes a bad decision, both are equally accountable.

Limited Liability Company (LLC)

This structure offers liability protection for owners (members) while allowing flexibility in management and taxation. Picture a tech startup where you and your co-founders want to protect your personal assets if the business incurs debt or faces a lawsuit. An LLC provides that safety net. It blends the simplicity and flexibility of a partnership with the liability protection of a corporation. For example, if your software development company is an LLC, you won’t be personally liable for the company’s debts.

Corporation

A separate legal entity from its owners, providing the highest level of liability protection. It requires more formalities and compliance. Large-scale operations like a manufacturing company might opt for this structure. The corporation can raise funds by selling shares, but it involves complex regulations and higher costs. There are two main types of corporations: C Corporations (C Corps) and S Corporations (S Corps). A C Corp is taxed separately from its owners, which can lead to double taxation on dividends, whereas an S Corp allows profits (and losses) to be passed directly to the owners’ personal income without corporate tax rates, but with certain restrictions.

Intellectual Property (IP) Protection

Intellectual property is the cornerstone of many startups, especially those with unique ideas or products. Here’s how you can protect it:

Patents

These protect inventions and processes, granting exclusive rights for a specified period. Imagine developing a revolutionary new smartphone app. A patent would prevent others from copying your idea for 20 years.

Trademarks

These safeguard brand names, logos, and slogans, preventing others from using similar marks. Think of your startup’s catchy name and logo. A trademark ensures no one else can use something confusingly similar.

Copyrights

These protect original works of authorship, including literature, music, and software. If you write a unique software code for your new game, copyright would ensure others can’t duplicate it without your permission.

Trade Secrets

These maintain the confidentiality of valuable business information, such as formulas, algorithms, and customer lists. Consider the secret recipe of a famous cola company. Keeping it a trade secret prevents competitors from replicating it.

Contracts and Agreements

Contracts are the backbone of business relationships. Here are some essentials for startups:

Founders’ Agreement

This document defines roles, responsibilities, equity distribution, and decision-making among founders. Before launching your new social media platform, you and your co-founders should clearly outline who does what and who owns what.

Employment Contracts

These outline terms of employment for team members, including roles, compensation, and confidentiality. Hiring a software developer for your startup? An employment contract will detail their salary, job duties, and confidentiality agreements to protect your business secrets.

Client Contracts

These establish terms and conditions for services or products provided to clients, including pricing, deliverables, and warranties. If your startup offers web design services, a client contract ensures both parties understand the project scope, deadlines, and payment terms.

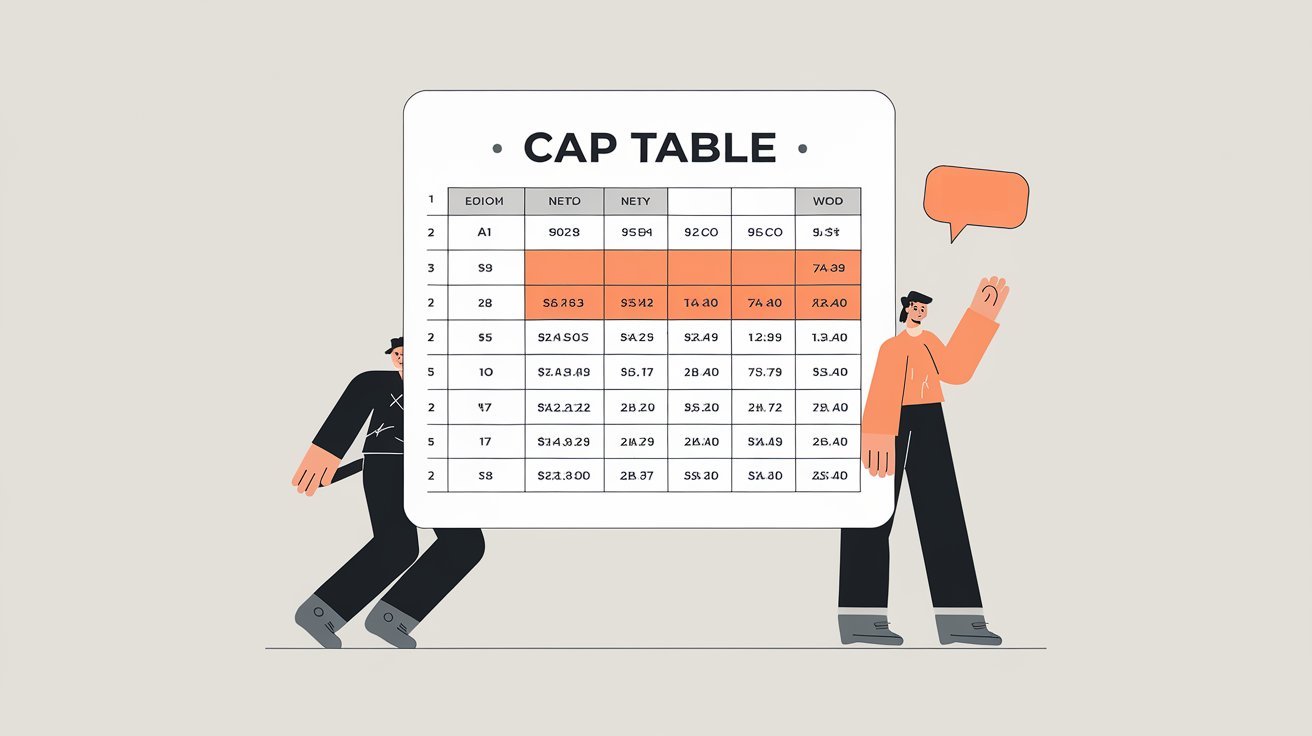

Investment Agreements

These govern terms of investment from external investors, including equity stakes, funding rounds, and investor rights. When attracting venture capital, an investment agreement details how much equity investors receive and their involvement in decision-making.

Regulatory Compliance

Compliance with regulations is non-negotiable. It varies according to your industry and location. Here are common areas to consider:

Taxation

Adhering to tax laws, including income tax, sales tax, and employment tax obligations. Your e-commerce startup must understand its tax liabilities, from sales tax on products to employment tax for staff.

Data Protection

Ensuring compliance with data privacy laws and safeguarding customer data. For a startup handling customer information, like an online retail store, understanding GDPR or CCPA is essential to avoid hefty fines. If your startup is in the healthcare industry and handles patient information, compliance with HIPAA (Health Insurance Portability and Accountability Act) is crucial. HIPAA sets the standard for protecting sensitive patient data, and non-compliance can result in severe penalties. Ensuring data encryption, secure storage, and proper access controls are part of HIPAA compliance.

Industry-Specific Regulations

Meeting requirements related to healthcare, finance, environmental standards, and more, based on your startup’s operations. If you’re in the fintech space, ensuring compliance with financial regulations is crucial to maintaining trust and legality.

Funding and Securities Laws

Raising capital is a lifeline for startups. Understanding securities laws is vital when seeking investment:

Securities Regulations

Compliance with laws governing the sale of securities, such as stocks or tokens, to investors. When your startup issues shares, it must comply with SEC regulations to ensure lawful transactions.

Crowdfunding Rules

Adhering to regulations when raising funds from a large number of investors via online platforms. If you opt for crowdfunding to launch a new product, following rules set by platforms like Kickstarter ensures legitimacy.

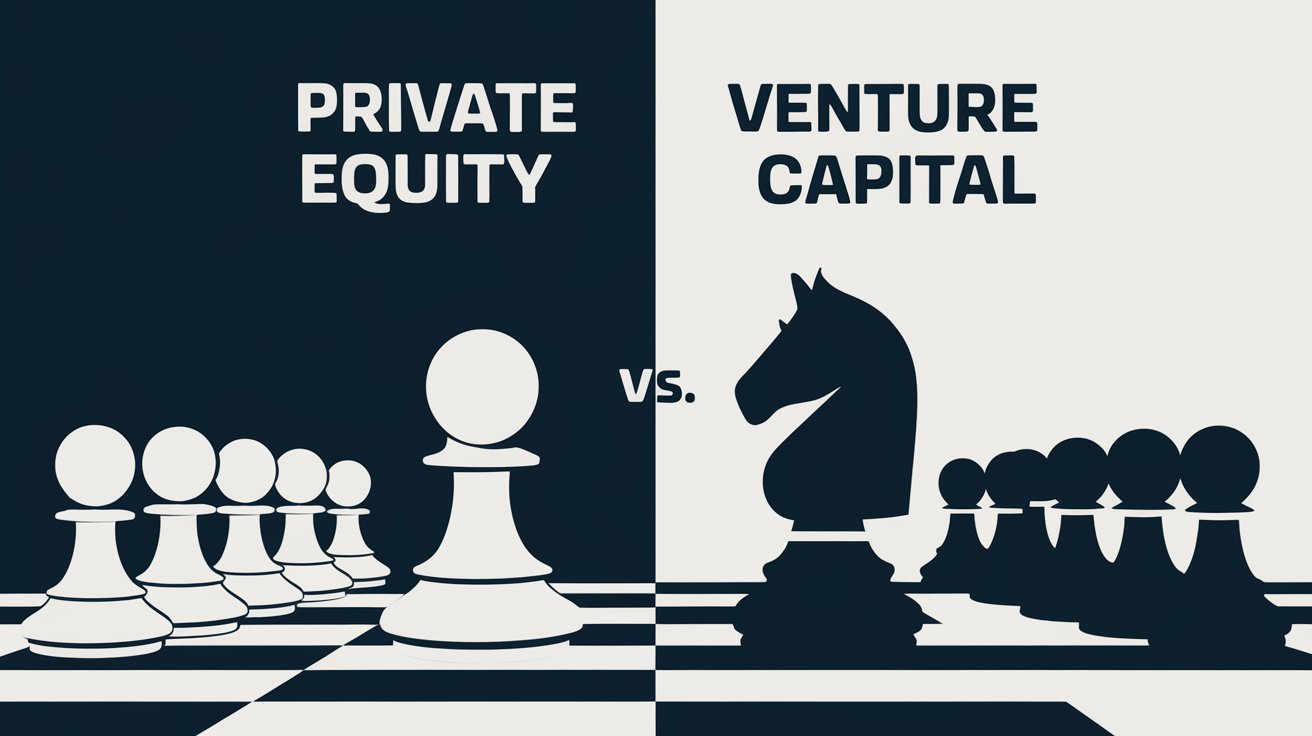

Venture Capital (VC) Agreements

Negotiating terms with venture capitalists, including valuation, dilution, governance, and exit strategies. Securing a VC deal means agreeing on how much of your startup they own, their role in decisions, and exit plans. For example, a VC might agree to invest $2 million in exchange for 25% of your company, but they will also want to set terms on how the company is run and have a say in major decisions, like selling the business.

Conclusion

Navigating startup laws can be a continuous learning journey for founders and entrepreneurs. Seeking legal advice from experienced professionals is highly recommended to ensure compliance and mitigate legal risks. By understanding and adhering to relevant laws and regulations, startups can focus on growth and innovation while operating within a legally sound framework.

Explore our comprehensive collection of legal tools and services to learn more.

Disclaimer: This guide provides general information and should not be construed as legal advice. Specific legal issues should be discussed with qualified legal professionals.

Leave a Reply